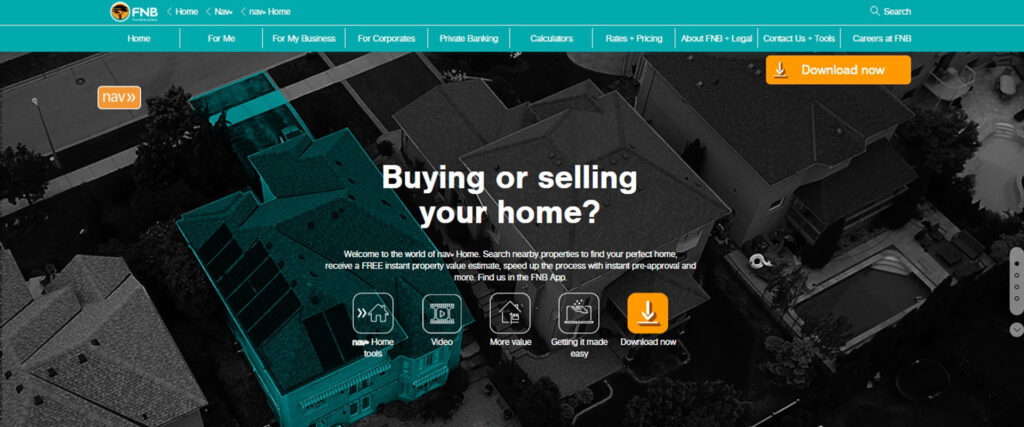

MAIN IMAGE: FNB’s latest banking app allows their clients to sell their houses to each other without an estate agent

The First National Bank’s latest innovation, a banking app that enables their customers to sell their homes privately to one another without using estate agents, have angered many of their clientele in the commission-based property sector.

Innovation is one of the core values at South Africa’s First National Bank (FNB), named last year as Africa’s most innovative bank at the 2017 African FinTech Awards for the second year in a row. However, the bank’s latest innovation on their smart phone application, called the nav>>, have placed them at loggerheads with thousands of their clientele, traditional commission-based estate agents.

The nav>> Home functionality enables FNB customers to securely list and sell their homes privately to FNB buyers who are most likely qualify for a home loan, without the help of an estate agent.

Jan le Roux, chief executive of industry body Rebosa, warns the bank’s latest disruptive tool could lead to unforeseen consequences for them. “One cannot dabble in the market and predict the exact outcome. FNB might help a number of their clients to sell their properties to the exclusion of estate agents, but it may just mean that they reach a tipping point where estate agents lose confidence in the bank.,” warns le Roux. “It must be kept in mind that the agent most often interacts first with sellers and buyers.”

The bank’s announcement of the online tool on 31 October already evoked an emotional response from commission-based estate agents on social media, with many threatening not to support the bank any longer while others called for the industry’s regulatory body the Estate Agent’s Affairs Board (EAAB) to intervene. Agents threatened to not only close their personal accounts but also not to refer any clients to FNB for home loan applications.

Leo Mlambo, president of the National Property Forum, an industry body that mostly represents black estate agents, says they received the announcement of the new app with dismay. “We in the National Property Forum have always felt that to transform this industry banks need to facilitate its growth rather than stifle sales. We are of the view that this decision will have serious implications for transformation as well as the industry at large. We are not aware of any consultation before this drastic decision was taken and we feel that we can both satisfy the banks desire for home loan clients and our objective of creating an open sales environment,” says Mlambo.

However, Mlambo says their members will continue to support FNB Home Loans but they would like the bank to adopt a more inclusive approach so that their members and the industry could benefit from any innovations that the bank introduces.

“We are on record as stating that we desire a partnership with the banks, originators and government and we strongly feel that this can be achieved through dialogue and consultation. Our country is struggling to employ our youth and we wish to emphasize that the property industry can play a major role in creating sustainable professions for our youth as long as barriers to entry are not perpetuated.

We hope FNB will engage with us and other stakeholders to further discuss this issue and hear our concerns,” ends Mlambo.

Adrian Goslett, regional director and CEO of RE/MAX of Southern Africa, expressed his doubts on whether the bank thought this move through before implementing it.

“Every company is entitled to devise and execute their own strategy but it remains to be seen if this will provide benefit to buyers and sellers. Personally, I feel as though FNB has taken a short-term view on this and I question how many estate agents will continue to promote them as a home loan financing channel when that same brand now competes with agents directly.

Continues Goslett: “It should be noted that, to the best of our knowledge, FNB chose not to engage or seek opinion from the real estate industry prior to making this decision, which seems to signal that they either expected a negative reaction or didn’t care what the reaction would be. I don’t consider this to be the wisest approach bearing in mind that the real estate industry provides them with a stream of potential business, and this stream can run dry as a result of this announcement.”

Raj Makanjee, FNB Retail CEO, in the media statement announcing the new app said with over 8 million properties registered in the deeds office, the bank sees the app as a significant opportunity to become a game-changer in the property industry.

“This latest innovation forms part of our broader strategy to be a bank which does more to help its customers through its integrated digital banking solutions. Our solutions coupled with the nav» platform continues to propel us further towards becoming a trusted money manager that is built on partnerships, efficiencies and innovation,” concludes Makanjee.

The banking app enables their customers to arrange to view a listed property and negotiate the price. The app also offers buyers access to instant free value estimates, a standard offer to purchase document, area and property reports as well as 50% back in eBucks on the first home loan repayment and up to 50% off bond registration fees with a selected panel of attorneys.

What do you think of this? Will this cause you to reconsider your support to FNB or is this an expected development in today’s digital age? Email your comments to editor@propertyprofessional.co.za.