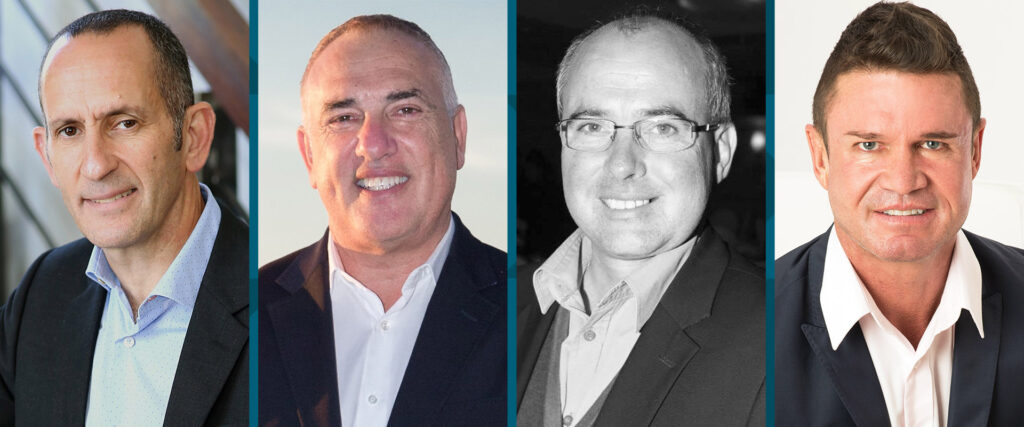

MAIN IMAGE: Herschel Jawitz, CEO of Jawitz Properties; Samuel Seeff, chairman Seeff Property Group; David Jacobs, Gauteng regional manager Rawson Property Group; Berry Everitt, CEO Chas Everitt International Property Group.

Budget 2020 has been broadly welcomed by the real estate sector. Find out from property experts what it means for the property market, particularly the announced relief on transfer duties for properties of R1 million or less.

Finance Minister Tito Mboweni surprised all with his Budget 2020 speech yesterday. Consumers can breathe a sigh of relief today following the announcement of no major tax increases and even personal income tax relief across the board. Given the weak state of the economy financial analysts had been predicting a worse outcome.

Herschel Jawitz, CEO of Jawitz Properties, believes that from a consumer point of view the 2020 Budget is significantly better than that of 2019, especially against what was expected. Given the budget deficit and the revenue challenges, an increase in VAT and virtually no increase in the personal income tax thresholds were expected, which would have hit consumers hard. He says this turned out not to be the case. Other than the usual increases in sin taxes and a less than expected increase in the fuel levy, consumers are going to get more tax relief than they got last year, with above inflation increases in the PIT thresholds. This, together with the recent interest rate cut, could lay the foundation for a shift in consumer confidence, which is key to the recovery in the residential property market.

“Consumers didn’t carry the burden of this budget and that’s good news for consumer confidence. The real burden for the current budget is carried by the government and their ability to fix the SOEs and reduce a bloated and inefficient public sector,” ends Jawitz.

What does it mean for the property market?

Budget 2020 has been broadly welcomed by the real estate sector, particularly the raising of the transfer duty threshold to R1 million, previously set at R900 000. The low to mid-market sector is currently the most active segment of the market. It is hoped that this will boost this sector further and encourage first-time buyers to take the big step of buying a home, especially with banks competing for new home loan business.

“Transfer duties of R1 million or less will go a long way to supporting first-time home buyers as well as those purchasing properties in the affordable end of the market,” says Andrew van der Hoven, Head of Home Loans: Standard Bank Group.

He adds that they hope this will allow for more South Africans to benefit financially from tangible asset ownership.

“On the whole, we believe that it was a positive budget insofar as that was possible under the current circumstances. In view of the continued weak outlook for the economy the market for sellers will remain tight,” says Samuel Seeff chairman of the Seeff Property Group, but continues that they expect an increase in buyers given the current favourable conditions – it being easier to obtain home loans, banks are granting higher bonds and there is more stock to choose from.

Seeff expects price growth to remain tight around the 4% range. Sellers in the low to middle-income price ranges to about R1.5 million are likely to see higher price growth, but above that, it will be highly area dependent. Upper end property above R5m is likely to continue seeing flat price growth.

Seeff further welcomed the plans by the minister to lower the corporate tax rate and expressed the hope that a lowering of the Capital Gains Tax (CGT) and high-end property transfer duty rates will also be looked at to reignite the property market. Especially, he adds, the upper end price bands which hold the propensity to generate significant property taxes and economic spin-off benefits.

David Jacobs, Gauteng regional manager for the Rawson Property Group, says affordability and consumer confidence are the key issues in real estate and the 2020 Budget addresses both.

“In the first place, the increase in the Transfer Duty threshold and the R14bn worth of income tax relief that were announced will put more money in consumer pockets, and that will make it easier for potential buyers to afford the homes they want and qualify for the home loans they need. This will add impetus to a market that is already benefiting from relatively low inflation, declining interest rates and competition among the banks for new home loan business.

“In the second place, several aspects of the Budget are certain to boost consumer confidence in the future of the country. These include the announcement that the public service wage bill is to be cut by at least R160bn over the next three years, starting with a R38m saving this year, as well as the allocation of an additional R2,4bn to the National Prosecuting Authority and the Directorate of Priority Crime Investigation to enable them to actually prosecute the cases arising from State capture and corruption investigations.”

He says other Budget elements that are likely to be positive for property are the R500bn allocated over the next three years to finalise existing land claims; the restructuring of the electricity supply sector (especially the decision to allow local authorities to purchase power from independent producers) and the additional allocations to assist municipalities to provide better services and maintain their existing infrastructure.

Another positive for the property market, is the additional funding allocated to municipalities. Berry Everitt, CEO Chas Everitt International Property Group, says for prospective home buyers and existing home owners, the additional R426bn allocated from national funds to assist local authorities to deliver better basic services and maintain existing municipal infrastructure is also encouraging news, “because everyone hopes to live in clean, tidy and well-maintained areas with uninterrupted access to water, electricity and other services. This also protects property values”.

Bruce Swain, CEO Leapfrog, says the announcement by the finance minister to support the property sector by adjusting the threshold for transfer duties “demonstrates a commitment to reducing the financial burden on consumers, and in particular on those looking to purchase property”.

“The decision to raise the transfer duty threshold to R1 million effectively means that properties that cost R1 million or less are exempt from transfer duty but transfer costs will still apply. Measures that provide for more investment in property bodes well for the economy at large,” he adds.

Dr Andrew Golding, CE Pam Golding Property Group, says the increase in the transfer duty threshold will help stimulate property transactions in this price band thereby increasing volumes and creating a ripple effect across the market in general – which will in turn benefit government income generation.

Golding adds that it is also pleasing to see that the Help to Buy scheme has assisted over 2 000 families to buy their own homes.

Crispin Inglis, CEO of PropertyFox says that while consumer spending is still under pressure, the no transfer duties payable on property up to the value of R 1 million is great news. “Not only are individuals going to be receiving some personal income tax relief, but the no transfer duties will give many an opportunity to get a foot in the property door.

Yael Geffen, CEO Lew Geffen Sotheby’s International Realty, says it wasn’t an easy budget, but the Minister did well with the small number of tools he had at his disposal.