MAIN IMAGE: Carl Coetzee, BetterBond CEO.

Carl Coetzee, BetterBond CEO

The decision by the SA Reserve Bank to drop the repo rate by 1% is a good start towards reviving the weak economy, especially for the property sector, but additional measures are needed to ensure the survival of this sector.

The surprise announcement this week by the Governor of the Reserve Bank, Lesetja Kganyago, of a further drop in the repo rate by 100 basis points to 4.25% per annum is welcome news for the property sector, as it takes the prime lending rate down to 7.75%.

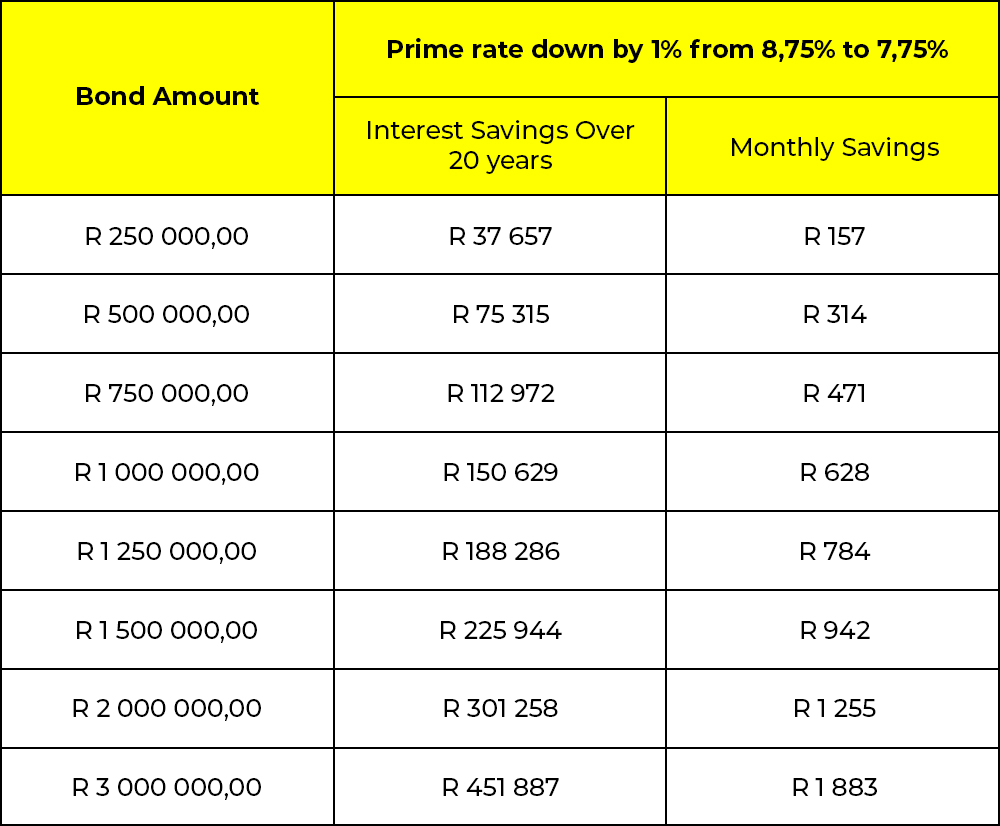

This 1% drop in the interest rate allows for significant savings, particularly in the long term, as demonstrated by the table below (calculations based on a 20-year loan period):

Any measures that seek to stimulate the market and ease the financial burden on the consumer’s pocket is a step in the right direction to buoy the property market. But while the drop in the repo rate is a good start, additional strategies will need to be put in place to secure the long-term survival of the industry.

One such measure could be to suspend the transfer duty on property valued up to a certain amount.

Raising the threshold on transfer duty, which currently stands at R1 million, to R3 million for a limited period of time, such as six months (with the option of reviewing after six months), could mitigate the risk of the industry contracting significantly as we start, what is sure to be, a slow economic recovery.

The savings to the buyer could mean the difference between both the confidence and the financial means to buy property, while government’s loss of income is set to be relatively low over the proposed six-month period. Government revenue is likely to be matched by the benefits gained on collecting tax on the earnings of all players within the property industry, and even the capital gains payable on properties sold, if such a stimulus measure were to be implemented.

A second measure that could go a long way in keeping the property sector ticking over is to reopen deeds offices around the country for the remainder of the lockdown, albeit at reduced capacity.

With the deeds offices closed, thousands of transactions are placed on hold, which effectively means a loss of income for thousands more who are directly and indirectly involved in related sectors and services. Furthermore, the backlog that will have to be cleared when it does reopen will add additional strain.

In a typical month in South Africa, between 10 000 and 12 000 bonds are registered in the deeds office and, as a sector, property contributes significantly to the GDP, supported by the fact that the deeds office processed R12 billion in registrations in April 2019.

We call on government to give urgent consideration to these two proposals. While the lowering of interest rates is likely to provide some much-needed stimulus to the economy and the property sector in particular, more is required. The added benefit is that revenue collection for the fiscus will no doubt be positively impacted through the knock-on effects of such measures.