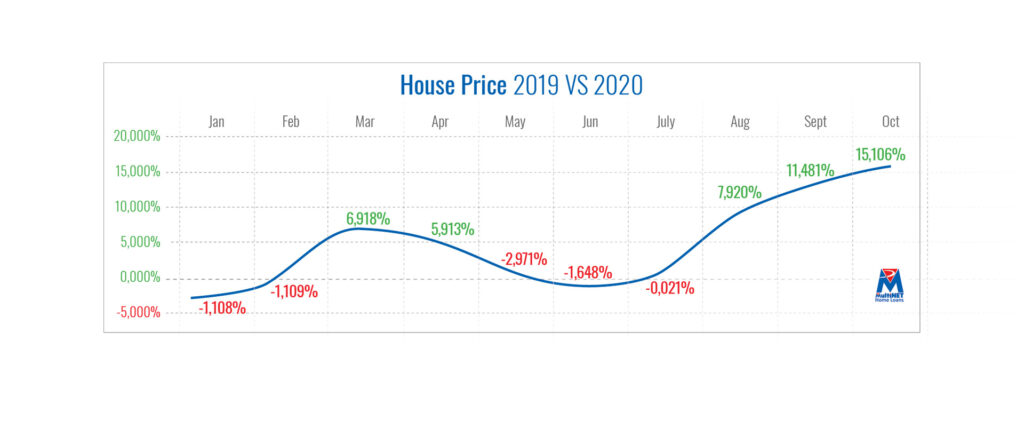

MAIN IMAGE: National average house price growth in 2020

During ‘hard lockdown’ the average house price went into a decline with low expectations of a fast recovery. A few months later, buoyed by a high volume of sales, the average house price is on a growth trajectory into the double digits.

Independent bond broker, Multinet Home loans, has seen a double-digit growth in average approved loans in 2020 vs 2019, says CEO Shaun Rademeyer. In October 2019, the average approved loan was R949 200.49 compared to 2020’s of R1 092 587.08 while October’s house price growth was 15.106%. “The reason is supply and demand; many consumers have now been able to afford property with the low interest rate, however with the banks providing payment holidays to many consumers, stock has become low for real estate agents, and consumers are also holding onto their properties,” explains Rademeyer.

Looking back

With the economy in recession, the housing market began the year slow with average house prices in decline. However, things started looking up. Before the country went into hard lockdown the housing market was showing a steady increase in bank competitiveness which resulted in higher loan to values being granted and first-time buyer propositions were becoming more prevalent among the major South African banks. “We could see this with an increase in accepted bond grant rate of 56.89% compared to the previous year’s average of 52%. March’s price increase followed on from the recovery we were seeing until the country went into lockdown,” Rademeyer says.

As expected, the average house price declined again during the ‘hard lockdown’ period. According to Rademeyer the reason behind the decrease in prices is that many sellers decided to accept the lower offers they were getting as buyers used the Covid-19 dilemma as a bargaining tool.

Signs of market recovery

The turnaround came after the South African Reserve Bank (SARB) stepped in with three consecutive interest rate reductions. This opened the market to a new set of home buyers who would pay the same price for a bond as the rent they were paying. The result was a high demand cycle with a relatively low supply, which resulted in approved bond prices / home prices increasing significant from 7.20% in August to 15.106% in September 2020 compared to the previous year.

MultiNET’s business partner, Comcorp confirmed the price growth and has also seen a double-digit growth in approved home loans. Rademeyer says that even though many consumers have been affected by the Covid-19 virus, the banks are still finding ways to continue its lending mandate as well as stimulating the property industry. The average accepted approved bond has remained the same in 2020, whilst the number of home loan submissions have surged over 50%.

COO MJ Dafel and CEO Gustav Kruger from propertycoza.co.za says that they have seen record numbers of sales being achieved by their offices and the low interest rate has most certainly contributed to the growth in the market.

Looking ahead at 2021

Inflation rates have remained low and there is hope that another interest rate cut could be on the cards. Financial analysts predict that the improvement of the rand against the dollar will also ensure that inflation is kept to a minimum giving more space for the SARB to possibly reduce interest rates further. “2021 will be an interesting year for the real estate industry, we will see more supply from developers and many of the current payment holidays will come to an end for consumers that have been affected by the pandemic. The result will be a balanced supply and demand bringing the double-digit growth we have seen over the past two months to a more realistic growth percentage,” ends Rademeyer.