MAIN IMAGE: Andrew Golding, chief executive Pam Golding property group; Shaun Rademeyer, CEO MultiNET; Paul Stevens, CEO Just Property; Siphamandla Mkhwanazi, FNB senior economist.

Starting out amid a second wave of Covid-19 infections and an adjusted Level 3 lockdown, 2021 unfortunately doesn’t yet look that different to 2020. In these uncertain times, there is good news as well as bad for the residential real estate sector.

South Africa was hit by a second wave of Covid-19 infections during the Festive Season. While an adjusted Level 3 lockdown brought relief to the overburdened health services sector, the renewed restrictive measures exacerbated the economic woes of many businesses, particularly in the tourism, entertainment, liquor and hospitality industries that had hoped to recoup some of last year’s losses during the holiday period.

This in turn could result in further job losses adding to the current unemployment rate of around 30% which in turn may negatively impact the buoyant buyer’s market seen since June last year and add further pressure to a rental market already in distress.

On a more positive note, it is expected that the Reserve Bank will keep the interest rate low until at least 2022. Dr Andrew Golding, chief executive of the Pam Golding Property group, also notes that businesses and households now know better how to adapt and survive in the prevailing climate of uncertainty than they were the first time round. Secondly, as vaccines are slowly in the process of being rolled out – most more slowly than expected – at least there is a potential end to the crisis in sight.

Home buying trends

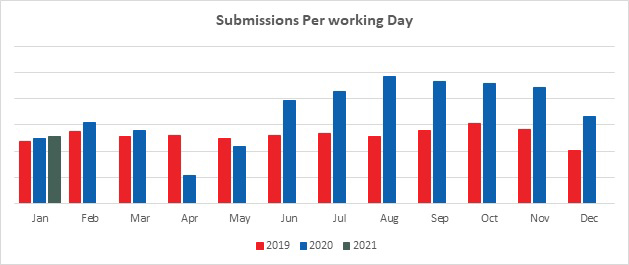

When the lockdown restrictions were eased in June last year, the real estate market saw a surprising upswing in home buying activity brought on by pent-up demand and the drastic interest rate cuts. Mortgage brokers like MultiNET saw a substantial increase in home loan submissions that has been sustained till the end of last year. “We saw a 33% increase in home loans submissions in 2020 vs submissions in 2019, with the last six months of 2020 accounting for 162% in growth,” says MultiNET CEO Shaun Rademeyer.

Graph: Submissions for home loans 2019 to January 2021.

Source: MultiNET

He predicts a continuation of the increase in submissions for the first two quarters of 2021 as first-time buyers and previous homeowners currently renting continue to find the low interest rate cycle an ideal opportunity to enter and re-enter the property market.

Equally encouraging was the response last year from the banks towards approving home loans. According to Rademeyer their stats show that the approved home loan increased by 6.25% in 2020 and within the last quarter of 2020 a 14.17% growth.

However, FNB senior economist Siphamandla Mkhwanazi expects that banks may become more cautious about approving home loans as the economic impact of the lockdown restrictions deepen. According to Mkhwanazi it is likely that we could see more jobs lost in the first half of 2021 as corporates start reassessing and looking for ways for cut costs. This is expected to affect the lower income groups more than the middle class and could affect home buying activity in this sector. “While the lower end of the market was the strongest during the second half of last year – both in terms of price growth and activity, with some areas running short of housing stock, these buyers are often the most sensitive to prevailing financial conditions (having had less time to build up their financial reserves) and thus are likely to feel the effects of the renewed deterioration in the economy,” explains Golding. He continues that since it is the lower middle sector of the market that has seen the highest demand (R700 000 to R1.5 million) rather than the very low price bands – these potential buyers may also feel the effects of a renewed wave of job losses as companies face a renewed period of lockdown.

On a more positive note, Berry Everitt, CEO of the Chas Everitt International property group, points out that the Rand is still at attractive levels for foreign buyers of SA property when compared to dollars, pounds or euros, which will help to bolster the luxury market once there are fewer travel restrictions between countries and continents. Another positive for the market, he says, is the decline in the number of SA home owners who are planning to emigrate – especially for the smaller towns and coastal areas that are seeing a surge of executive semigration as the remote-working trend gains ground, and a corresponding decline in housing inventory.

Rental market

Many good tenants have realized that with the extremely low interest rate it is more affordable for them to own a property than to rent. “A very large number of quality tenants have become home buyers in 2020 due to the lower interest rates, and on top of that landlords have had to contend with extensive non-payment issues due to the economic effects of Covid19 pandemic and lockdown,” says Gerhard Kotze, managing director of RealNet estate agency group.

The exodus of good tenants into the homeowners’ market has not been good for the rental market. The rental market has not been at levels like this since the 2008 financial crisis, says Paul Stevens, CEO of Just Property. “Vacancies and tenants in arrears are at all-time highs and with TERS relief having recently come to an end, I think we are going to find rentals collections will be under pressure for at least the 1st quarter of 2021.”

Kotze therefore expects that most landlords and rental agents are likely to apply increasingly strict credit and rental record checks. Deposit requirements are also likely to rise. “And, unfortunately, a large number of those who are likely to be looking for rental properties now are people who already have some financial problems, so there will be a need to be even more careful,” he adds.

Stevens also notes that the holiday/short term rental market has been under severe pressure this year and, as the South African economy will continue to be under pressure during 2021, this sector will continue to be strained as people have fewer surplus funds for holiday use.

The positive side, says Kotze, is that he expects that many property owners may decide to sell off their portfolios now, so “bargain” flats and townhouses could come on the markets as a result.

Changing housing needs

Mkhwanazi makes the interesting observation that we are not seeing a new home buyer market but rather more a reflection of how people’s housing needs have changed as a result of the lockdown. “The home now has to double as a living space as well as an office, consequently we are seeing demand growing for sectional title and estate housing where there is also space for gardening, he notes. Rademeyer agrees that many homeowners, especially who have families, have realized that they need more space as the trend of working from home is unlikely to change soon. “A small garden; an extra room and enough me space will become important. Be ready to see more upgrades and consumers willing to spend extra for size and luxury,” he says.

Remote working also provides homeowners with the opportunity to work from more remote areas as long as there is reliable Wi-Fi available. Stevens predicts that we are going to find more people relocating away from cities to towns in areas previously viewed as holiday or weekend destinations such as Ballito in KZN and Hermanus and Langebaan in the Western Cape.

A changed real estate sector

Globally the real estate sector has had to adopt similar safety and hygiene practices – face masks, social distancing and sanitizing are going to be with us for a while. “It is imperative that the real estate industry continues to comply with the Covid protocols – namely Covid waiver forms, wearing of masks, hand sanitising prior to viewings, among others,” says Golding.

Home viewings now include limits on the amount of people allowed inside a home at one time. In a recent article by RE/MAX LLC, agents note that sellers often now have special instructions for agents such as requiring temperature checks or asking guests to wear shoe coverings inside their homes.

Customer service

Buyers, sellers, landlords and tenants will be looking for more value in the services that are offered to them. Practitioners in the real estate sector need to ensure that we shift our focus from a transactional business to a relationship-based business, says Stevens. “Service levels in our industry are generally very low, especially considering that we are dealing with major investments that often involve major emotions too. For the person selling, buying or renting a home, it’s a very personal thing and an opportunity to touch hearts and influence people. We have to become customer-obsessed,” he says.

Agents must place a high emphasis on maximizing the exposure of the property utilising all available channels adds Golding. He continues that equally important is to provide ongoing feedback to sellers on the market and the response from buyers – and in line with this, agreeing on any necessary adjustments to the marketing strategy to ensure the property is sold for the highest possible price.

Technology

Increased use of technology in the home-buying and selling processes is also a global trend. More buyers now start their search for a home online while touring homes via video calls and video tours are increasingly popular to minimize personal contact. “Technology is becoming a defining factor of our business environment and the lockdown certainly pushed the benefits of technology to the forefront,” says Stevens.

Harder for smaller agencies to compete

Kotze says the pandemic has already caused a contraction in agency numbers similar to that experienced after the Global Financial Crash in 2008. “As a result, many part-time or non-serious agents have exited the market once again, and the industry is again seeing significant convergence of the top performers around the larger companies with established brands and, equally importantly, the knowledge, technology and means to support agents who want to work remotely.

“It is going to make it harder for independent agencies to compete with your bigger franchise brands,” agrees Stevens. He sees systemisation of business processes being a key facet in the ongoing success of a real estate business and says survival will be predicated on creating efficiency: “Not only to make the agents’ role easier but, more importantly, to make the customer experience with your brand a better one,” he explains. “Within our brand we are already seeing stronger franchisees absorbing smaller franchises around them and using the economies of scale to implement efficiencies in terms of staffing, offices and systems to create a business is financially robust.”

Stevens also anticipates real estate transactions becoming more integrated with other fields, such as conveyancing. He also predicts they’ll be more automated and streamlined thanks to broader adoption of CRM systems.

There are so many elements to a property transaction and that presents an opportunity to expand one’s service offering and one’s revenue streams. Property practitioners who are prepared to think outside the proverbial box and go the extra mile will thrive.