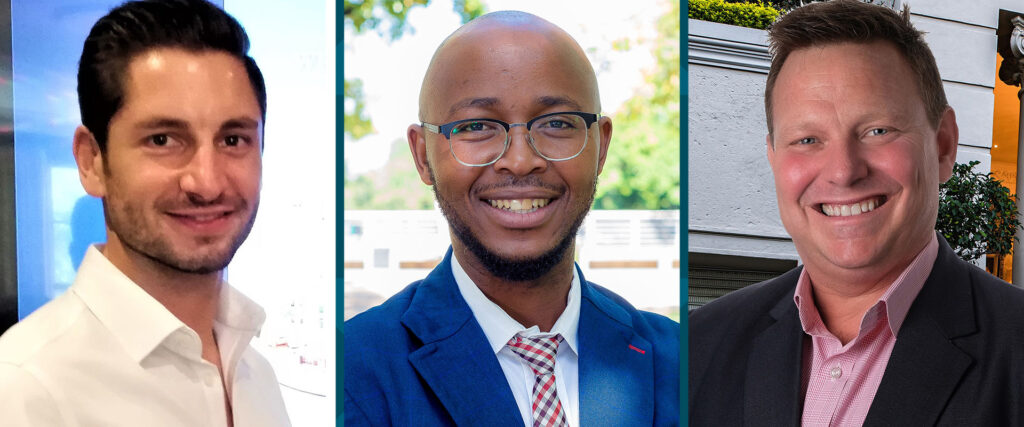

MAIN IMAGE: Nick Gaertner, director Knight Frank SA; Siphamandla Mkhwanazi, FNB senior economist; Rory O’Hagan, head of luxury portfolio with Chas Everitt International property group.

Despite the pandemic it seems buying luxury real estate is back in vogue as an investment option for the uber-wealthy, both internationally and locally.

According to the attitudes survey for the 2021 Knight Frank Wealth Report 26% of ultra-high-net-worth individuals (UHNWIs) are planning to buy a new home in 2021 with the biggest driver the desire to upgrade main residences. In addition, the latest statistics from the US reveal that luxury home sales there have been soaring since September 2020 and are currently almost 61% ahead of where they were at the start of last year – even though the US has been so hard hit by the Covid-19 pandemic and its economic aftermath.

Real estate a safer investment option

“Luxury real estate is back in first place among the most favoured investment options for HNWIs and the reasons are not hard to find,” says Rory O’Hagan, head of the Luxury Portfolio© division of the Chas Everitt International property group.

He explains that for a start, stock markets everywhere have been hammered by the pandemic and are likely to remain volatile as its the economic, social and political effects continue to play out, which makes it very difficult to keep track of the returns on equity investments. And along with gold, real estate has traditionally been seen by investors as a safer alternative in such circumstances.

Secondly, he says, luxury real estate prices have fallen drastically since 2019, and astute investors are taking the opportunity to upgrade to bigger and better primary residences, or to purchase additional properties in the expectation of excellent future value growth. This trend of price adjustment in the upper-end is confirmed by FNB senior economist Siphamandla Mkhwanazi who says this happened due to

receding demand and selling due to emigration. Available data shows properties in the top 1% price distribution declined by an average -5.5% in 2020.

Working from home trend growing

However, Mkhwanazi forecasts a less negative price growth in the upper market in 2021 than last year as owners delay selling due to unfavourable selling conditions and also because emigration slowed as the pandemic restricted international travel. Real estate agencies say they are seeing a definite increase in the number of people interested in owning a larger home in an upmarket area or luxury lifestyle estate.

The growing working from home trend is a big driver. Comments Nick Gaertner, director of Knight Frank South Africa, “people are looking for homes that offer a full lifestyle, that is homes that are peaceful where they can relax, but that also provide space and opportunity for exercise and work from home offices without making them feel that they are constantly at work”. He adds that while more compact, easy maintenance, lock-up-and-go properties were starting to become more popular, there has been a definite increase in the number of people interested in larger lifestyle properties since the hard lockdowns have ended.

Well-priced properties are definitely selling much more swiftly than they were a year ago says O’Hagan. This scenario is playing out in all the luxury home markets across South Africa, from the southern suburbs of Cape Town the Cape Winelands, Gauteng and the north coast of KwaZulu-Natal – especially if sellers are willing to lower their price expectations.

Tania Smit, who heads up Pam Golding Auctions, says people are attracted to the lifestyle afforded by a luxury home, especially as many people are now, following the need for social distancing, placing health and generous indoor/outdoor areas for exercise, family activities and workspaces at the top of their priority lists. She adds that homes in secure, lifestyle estates are also attractive especially if they come with sizeable outdoor spaces, amenities, cutting edge technology, security and eco-friendly and energy-saving features.

Residential rental still a good investment

The pandemic has not been kind to the rental market. The increased demand for more living space coupled with a record-low interest rate saw many tenants exchange rental living for home ownership if they could afford it. In addition, the rental market saw an influx of former short-term rental properties as property owners tried to secure some income while travel restrictions limited tourism. The latest TPN vacancy survey reports an overall 12.91% vacancy rate. With continued job uncertainty (Stats SA reports that 66 000 professionals lost their jobs towards the end of last year), Mkhwanazi says pressure in the rental market to intensify and they expect more stock to be released.

In the light of this, is it still worthwhile for investors to look at rental properties? According to Gaertner, the answer is a definite yes. “While the future of office rental space is coming under a lot of speculation, we do feel that residential rental is still a sound investment for HNWI,” he says. However, he adds that it is important for investors to look at the following:

- Do not overcapitalise on investment properties and understand the market. One of the biggest mistakes that investors can make is overspending says Gaertner. This needs to be a business-based purchase.

- It is important to look at the rental property as a business in its entirety and also consider the capital growth being achieved. (i.e. even if a rental property only gives a 7% net rental return each year, if the property is held for the medium to long term, it is likely to show an average capital growth rate each year of between 5% – 9% which will need to be added to the rental return in order to achieve a full return on investment figure).

So, the wealthy are making the most of the favourable market conditions by either upgrading to bigger homes or buying second ones. Why does this matter? According to Liam Bailey, Knight Frank’s global head of research, the wealthy and where they invest their money forms a central part of the story if we are to understand the market and asset performance. “From policymakers to investors, a lack of insight into the behaviour and attitudes of the ‘1%’ risks a serious misreading of economic trends,” he says.