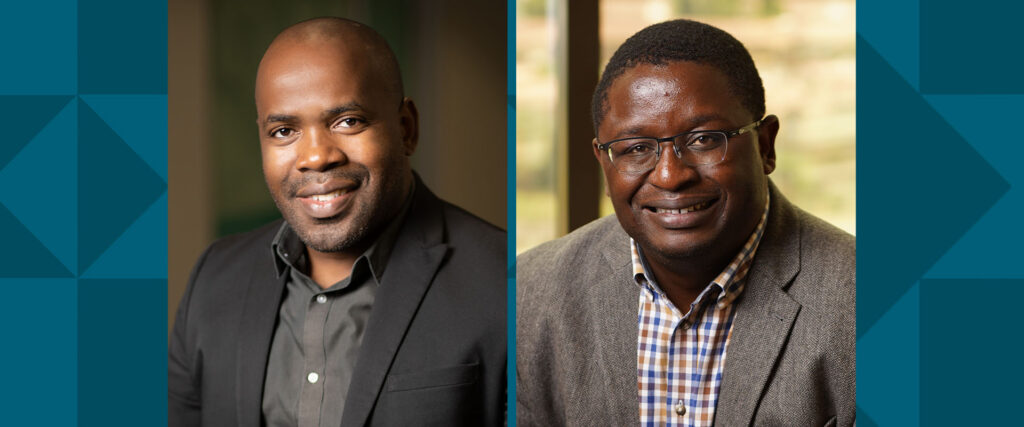

MAIN IMAGE: Mfundo Mabaso, Growth Head at FNB Secure Lending; Lee Mhlongo, CEO of FNB Property Finance

Danie Keet

Traditionally, mortgage applicants consisted of a two people, married or otherwise, but now banks are launching lending solutions that enable groups of people to buy a house together.

A new collective buying solution, that allows up to eight people to buy a property collectively and take out a home loan for up to 30 years has recently been introduced by FNB to help make it affordable for South Africans to buy and invest in residential property by sharing monthly bond repayments with others.

“Collective property buying is for individuals or non-trading juristic entities, such as a trust of individuals who want to invest together. The offering does not extend to trading entities though,” says Mfundo Mabaso, Growth Head at FNB Secure Lending.

Mabaso explains that the scheme allows for up to 12 people. However, if you apply using the FNB App, the application is limited to eight people and includes applicants who are married in Community of Property (COP). Applicants of more than 12 people can apply using a customer-facing channel such as going to a bank branch and talking to a banking professional.

Once the application has been submitted, the bank will review each customer’s credit profile, including the nature of income, expenses and affordability.

He says these are assessed in conjunction with credit bureau profiles and the information on the account conducted with various creditors and banks.

“The solution allows for customers to elect and deposit funds directly into one transactional account. They can also run debit orders or request a stop order payment from their transactional accounts.”

Mabaso says there is no loan limit for the collective property buying product. The loan amount is based on what the applicants as a whole can afford.

Furthermore, they have a split billing functionality, which allows multiple parties to pay on various dates at specified contributions. For example, if there are five applicants, each person is responsible for 20% of the total repayment amount.

It is important to note, however, that as with any home loan, customers remain jointly and severally liable. This means that if one owner cannot pay, all the other owners will be responsible for the payment of those who cannot pay.

“Since launching on 18 August 2021, the market sentiment for collective buying has been positive. Real estate professionals are excited about the prospect of this product, as it assists with affordability in the affordable housing market,” notes Mabaso.

He says real estate experts are positive that this will increase activity in higher-income segments. Apart from driving up first-time home buyer activity, real estate experts believe that this will spur on more investment-buying activity among likeminded people.

Stokvel

Mabaso says it is important to understand that collective property buying is different from a stokvel structure.

A property stokvel structure differs in that there could be multiple properties involved over a period, where one property must be built and then occupation takes place in order of preference, administered by the stokvel. This often requires monthly contributions to place towards the stokvel. It may require cash to fulfil on the property purchases if there is no finance.

“The collective buying holds applicants jointly and severally liable over the individual property. This property occupation must be decided between the applicants,” says Mabaso.

Costs

Although interest rates are at historic lows, many people still cannot afford to buy property.

Lee Mhlongo, CEO of FNB Property Finance, says their records show that when a customer considers purchasing a property, they tend to forget the additional costs. These include registration costs, transfer duties and sometimes a deposit, presenting more barriers for an individual to afford the property.

“The advantages of collective property buying with friends and family mean that customers are now able to share the costs equally to make the purchase and the process affordable. Additionally, customers will enjoy reduced monthly repayments and personalised rates,” says Mhlongo.

Customers who fall within the ‘gap housing market’ and whose income is between R3,501 and R22,000, are still encouraged to consider Finance Linked Individual Subsidy Program (FLISP), a government home ownership assistance programme.

FLISP is intended for individuals whose income is not enough to qualify for a home loan but exceeds the maximum limit applicable to access Government’s ‘free basic house’ subsidy scheme.

The benefit of a cash contribution from such a programme can significantly reduce the financial burden on households, according to Mhlongo.

“We urge prospective home buyers to take advantage of buying as a collective and start their journey to own property. This is another way we are helping our customers to own their dream home and unlock their wealth creation journey, through investing in property as a group,” says Mhlongo.