MAIN IMAGE: Johette Smuts, Head of Data Analytics at PayProp

It is almost the end of the year and time to have final look at the rental market.

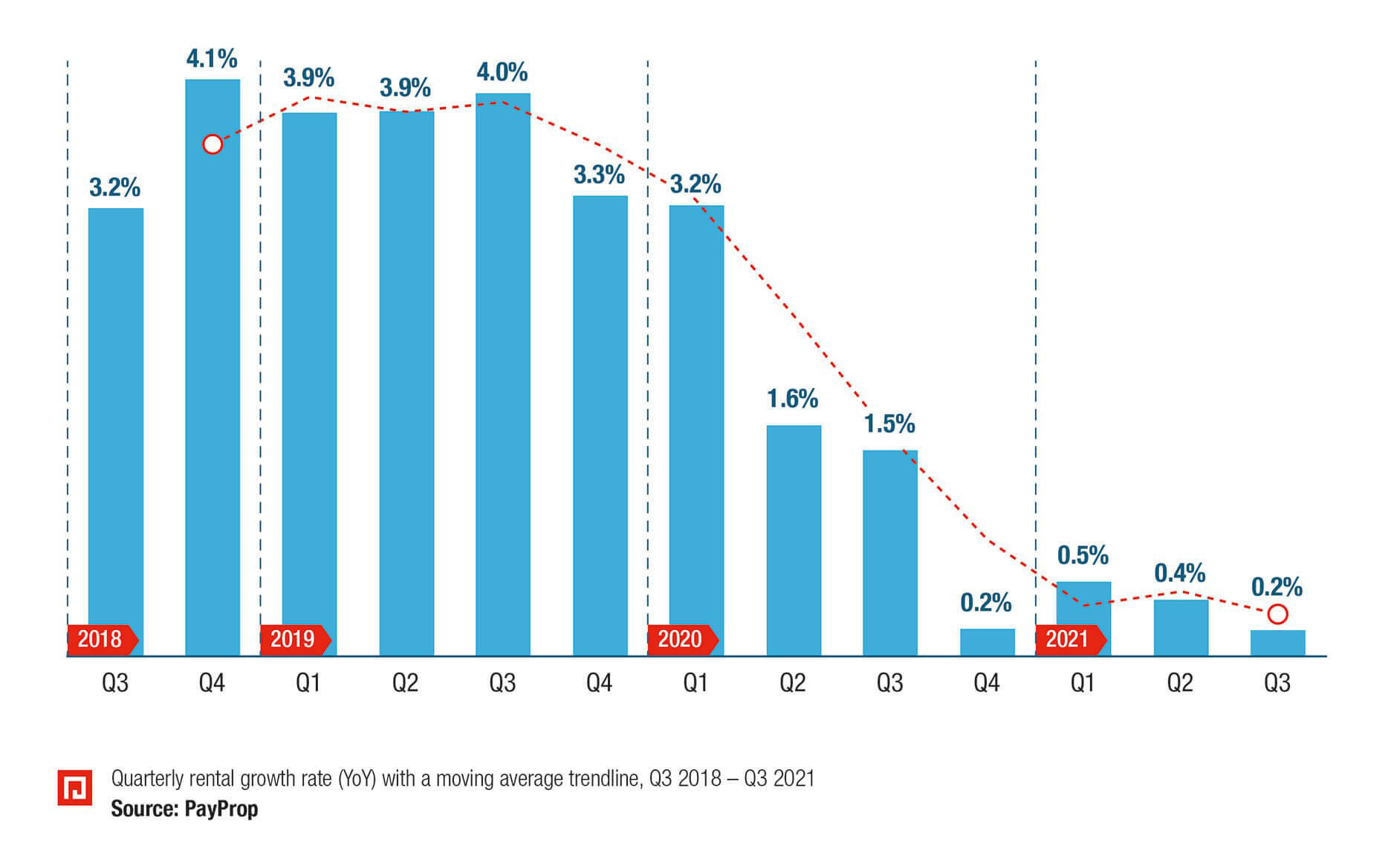

According to the quarterly PayProp Index, there was continued slow growth in the rental market in the last quarter and the subdued rental growth seen over the last year continued into the third quarter of 2021, as predicted previously.

Year-on-year rental growth barely moved the needle, measuring 0.1%, 0.3% and 0.2% in July, August, and September respectively. Meanwhile, high levels of inflation continued during the quarter. Transport costs are a major driver of this – the price of petrol increased by almost 20% over the last year alone. Combined low rental growth and high inflation have a double-barrel impact on rental businesses – commission income grows more slowly than costs, which leads to a drop in income in real terms.

Rents under pressure

According to Johette Smuts, Head of Data Analytics at PayProp, tenant affordability continued to put downward pressure on rents.

“Add in a record-high unemployment rate and an economy that is slow to improve, and we can’t foresee a recovery in the rental market anytime soon. Rent increases are likely to remain subdued over the short- and medium-term. Nationwide quarterly rental growth over the last 18 months stands in stark contrast to previous years,” she said.

Growth patterns

National rental growth has been below 1% for four consecutive quarters while the average rent increased by just R10 between Q3 2020 and Q3 2021.

How did the provinces fare?

Eastern Cape

The Eastern Cape outpaced all other provinces in rental growth through most of 2021. It topped the leader board in Q4 2020 with a year-on-year increase of 3.9%, and again in Q2 2021, notching up 2.1%. That came to an end in the latest quarter, however, when the average rent in the province remained unchanged at R6 217 – the second lowest rent after Northwest.

Free State

In Q4 2020, Free State rents increased by 1.6% year on year – the second highest growth rate after the Eastern Cape. However, the province has suffered three consecutive quarters of negative rental growth since then, with rent tumbling by 2.5% in the latest quarter. This was the worst performance across all provinces. The average rent in Q3 was R6 295, down from R6 456 the year before

Mpumalanga

A round of applause for Mpumalanga, the only province to experience positive year-on-year rental growth in each of the past four quarters. It also enjoyed the fastest rental growth of any province in the most recent quarter. In Q3, average rents increased by 3.5%, up R257 from R7 442 to R7 699. Rent is now just R101 cheaper in this province than the national average of R7 800.

Northern Cape

The Northern Cape experienced a few more ups and downs than most provinces over the past year. Rents increased by 1.1% in the most recent quarter after negative year-on-year growth the quarter before. The average rent in the province stood at R8 069 in Q3 2021, up from R7 979 the year before and still above the national average of R7 800.

Northwest

Northwest has not seen rents fall since Q4 2020. In the two following quarters rents increased year on year by 3.7% and 0.7% respectively. Q1 2021’s 3.7% was the highest out of all the provinces. In the most recent quarter, rental growth measured 2.1%. Average rents reached R5 257 in Q3 2021, up from R5 147. However, the province still has the lowest average rent in the country.

Western Cape

The Western Cape had Q3’s second highest rental growth after Mpumalanga, at 2.5%. Before the 1.8% year-on-year increase seen in Q2 2021, the province had experienced four consecutive quarters of negative rental growth. Average rent in the province increased from R9 041 a year ago to R9 266 in the most recent quarter. It is still the most expensive province in which to rent.

Arrears

“The start of the pandemic devastated the South African economy, impacting businesses and consumers alike. Many tenants experienced a loss of income, whether temporarily or through permanent job loss, and the effects of this can be seen in arrears figures.

“We consider two arrears metrics – both are weighted according to provinces’ contribution to GDP. Firstly, the percentage of tenants in arrears records the number of tenants in arrears as a percentage of the total number of tenants. Secondly, the average arrears percentage is the average amount owed by tenants in arrears as a percentage of the average rent. An average arrears percentage of 80% therefore means that on average, a tenant in arrears owes 80% of one month’s rent,” Smuts explained.

The percentage of tenants in arrears has been improving steadily since it peaked in Q2 2020. In fact, in Q3 2021, it was down to 19.1% – lower than before lockdown.

Tenants in arrears

The loss of income that many tenants experienced at the beginning of lockdown caused the percentage of tenants in arrears to increase from 19.4% in the first quarter of 2020 to 24.9% in the second.

“Fortunately, many of these tenants were able to return to work from June and resumed their rental payments. Accordingly, the percentage of tenants in arrears has been declining steadily since it peaked in Q2 2020. In fact, in Q3 2021, it was down to 19.1% – lower than before lockdown.

“For tenants in arrears, the average arrears percentage has also declined each quarter since its peak in the third quarter of 2020. In Q1 last year, tenants in arrears owed on average 78.5% of one month’s rent. That increased to 96.3% in Q2 (the first quarter in lockdown) and further to 104.6% in Q3.

“For this metric to improve, tenants in arrears have had to pay their full rent plus an additional amount towards their debt each month – not an easy feat in the current economic climate. For this reason, the average size of arrears appears a bit more stubborn in coming down. In the most recent quarter, tenants in arrears owed on average 82.3% of one month’s rent – still slightly above the 78.5% seen before the pandemic. However, the improvement in this metric over the past year is encouraging,” Smuts concluded.