MAIN IMAGE: Gavin Lomberg, ooba Home Loans CEO

ooba Homeloans

Relatively strong property price growth and homebuyer demand have helped the Western Cape maintain its status as the darling of the residential property market. Still, data from ooba Home Loans reveals that several often-overlooked regions are poised to impact the industry’s ongoing recovery.

Looking at regional outliers, ooba Home Loan’s data reveals that both Mpumalanga and the Eastern Cape have registered double-digit property price growth in the first few months of 2024, while Gauteng South & East has managed to attract a large percentage of first-time homebuyers.

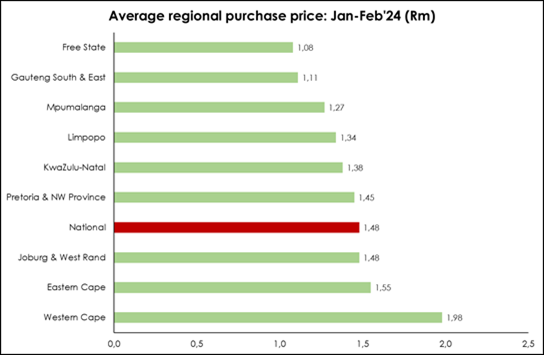

“While regional gains are cause for celebration, our data shows that the underlying (6-month Moving Average) rebound of House Price Inflation (HPI) across the country for both repeat and first-time homebuyers has remained intact,” shares ooba Home Loans CEO Gavin Lomberg. “The overall average property price paid in February 2024 by ooba Home Loans customers stands at R1.479 million – a 2.3% year-on-year increase.”

Mpumalanga beats Western Cape in HPI, and first-time homebuyer demand

Move aside Western Cape: it’s time for the ‘land of the rising sun’ to have its moment in the spotlight.

Mpumalanga recorded the largest increase in the average price paid by ooba Home Loans customers during January and February 2024, showing +17.6% year-on-year growth in the property price and taking the average price in the region to R1.27 million.

Property prices in the Western Cape grew by +10.4% in the same period.

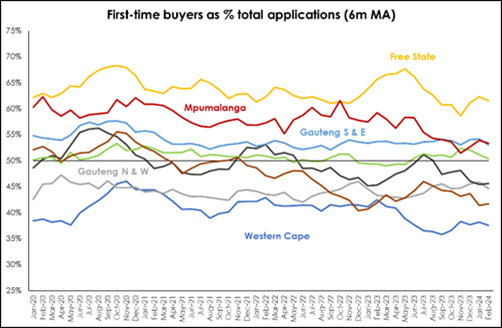

“Despite its impressive growth, Mpumalanga remains one of the most affordable regions for property in the country, surpassed only by Gauteng South & East and the Free State,” reassures Lomberg. “This affordability is a beacon of hope for first-time homebuyers, as evidenced by the high volumes of first-time homebuyer home loan applications in Mpumalanga, which currently make up 51.1% of ooba Home Loans’ applications processed in the region.”

Nationally, the volume of first-time homebuyer applications dropped to 44.6% in February 2024, the lowest level seen in seven years. “Elevated interest rates, rising petrol prices and a sluggish economy have taken their toll on household finances and, as a result, delayed many young buyers’ property ownership dreams,” Lomberg says. “Even the Western Cape has not been immune to this downward trend, with first-time buyer applications in the region a mere 36.8%, 14.3 percentage points lower than Mpumalanga and 25.9 percentage points lower than the Free State.”

Gauteng South & East back in the good books with first-time buyers

First-time homebuyer demand is also elevated in Gauteng South & East, constituting 52.0% of all applications processed by ooba Home Loans in this region in the first two months of 2024.

Affordability plays a key role, with the region offering the second cheapest property prices in the country paid by both repeat (R1.17 million) and first-time homebuyers (R1.03 million) in the first two months of 2024. Only the Free State offers better deals for price-conscious first-time homebuyers, with an average purchase price of R960,000.

Investment property demand not limited to the coastal regions

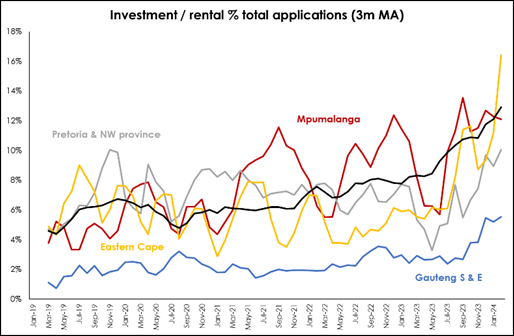

The Western Cape remains the driving force behind a national uptick in demand for buy-to-let and investment properties. In February 2024, 32.3% of applications processed by ooba Home Loans were from the Western Cape, up from 30.1% in January.

However, the Eastern Cape continues to be a strong contender. The region is one of the top performers in the investment/buy-to-let category, aided by its retirement and holiday destination appeal.

Applications for investment/buy-to-let properties in the Eastern Cape have risen to an average of 16.6% of all applications processed by ooba Home Loans in January-February 2024, followed by Mpumalanga (11.4%) and Pretoria & North West Province (10.1%).

“Mpumalanga, Pretoria & North West provide great value for money for would-be landlords, with the thriving mining and agricultural industries in both regions ensuring a steady stream of gainfully employed tenants,” comments Lomberg.

Bank lending behaviour across the regions

While residential property price growth has regained some momentum in the first months of 2024, bank approval rates are down slightly. In February, there was a very slight dip in home loan approval rates across most regions and a noticeable decline in Limpopo and the Eastern Cape.

“However, this is another instance where Mpumalanga bucks the national trend, with the region’s home loan approval rate improving nicely during the same period, rising to almost 82% in February 2024 (6m MA),” Lomberg says.

Overall, lending conditions remain supportive, with both the average loan-to-value ratio and concession relative to prime improving in February. The national average rate concession to prime is currently at -0.52%, with the biggest discounts available in the Western Cape at an average of prime -0.73%.

“This indicates the banks’ willingness to work with homebuyers to ease affordability in these trying economic times. Similarly, the banks are willing to lend at a higher loan-to-value (LTV) ratio, despite the perceived higher risk to lenders”.

Lomberg notes that the Free State, in particular, has seen a marked improvement in LTV, rising from the lowest regional ratio in early 2023 to the highest in early 2024, currently at 94.1% (6m MA).

“It’s clear that the inland regions are slowly beginning to challenge the Western Cape’s status as the residential property market darling, fuelled by increased activity from bargain-hunting first-time homebuyers,” Lomberg concludes.