MAIN IMAGE: Chris Tyson – Tyson Properties CEO, Rhys Dyer – ooba Group CEO, Samuel Seeff, Seeff Property Group Chairman, Adrian Goslett – regional director and CEO of RE/MAX of Southern Africa, Dr Andrew Golding – chief executive of the Pam Golding Property group, Leonard Kondowe – national manager at Rawson Finance, Yael Geffen – Lew Geffen Sotheby’s International Realty CEO

Editor

The Monetary Policy Committee‘s (MPC) decision to maintain the repo and prime lending rates at 8.25% and 11.75%, respectively, for the fifth consecutive meeting, is a significant move that analysts had widely anticipated. This decision, made just before the Easter weekend, holds considerable importance for real estate.

Contextualising the South African Reserve Bank’s decision, ooba Group CEO Rhys Dyer notes that both the American Federal Reserve and the European Central Bank (ECB) have indicated that they are close to cutting rates but “that they’re awaiting more data – particularly wage data – to confirm that now is the right time to adopt this course of action.”

He adds that “there remain real fears of a resurgence of inflation, so the world’s major central banks are going to err on the side of caution until they receive additional data to indicate that inflation will recede into target ranges, ensuring that the decision to cut rates is a considered one.”

Leonard Kondowe, national manager at Rawson Finance, suggests we might start seeing interest rate cuts from the next quarter of 2024. This implies that homeowners and others with prime-linked loans should brace themselves for a few more challenging months ahead.

How does this repo rate decision impact the property market?

First-time buyers

“Applications from first-time homebuyers (FTHB) dipped to 44.6% in February ’24 – the lowest levels seen since March 2017. This is a clear indicator that the rates-sensitive FTHB segment is choosing to delay their property purchases until interest rates are cut, a decision that is dampening property demand across the country,” says Dhyer.

Buying activity levels continue to be supported by strong bank appetite for home loans with approval rates still strong and positive shifts in the form of both the average loan-to-value ratio and interest rate concession relative to prime improving last month.”

Bond pre-qualification becomes critical, especially for first-time buyers. Both Dhyer and Kondowe agree, both in terms of making sure they can afford the property and also because it improves their application success rate. “Our data shows that the approval rate for home loan applications linked to a pre-qualification remains steady at 91.2%, while those not linked to pre-qualifications currently sit at 80.2%,” says Dyer.

Where are buyers buying?

Tyson Properties CEO Chris Tyson says the property market in Cape Town remains strong, and the positivity that is evident in both KwaZulu-Natal and Gauteng is encouraging. Post the election, and in the event of a much-anticipated drop in interest rates, he expects a surge in first-time home purchases as well as a continued upward trend in property transactions countrywide.

How is the market doing?

Samuel Seeff, chairman of the Seeff Property Group, notes that sales volumes have declined significantly since the middle of last year, and price growth has stalled at just about under 1%, which is not a great incentive for sellers. However, it is still good for buyers, who, despite the higher borrowing costs, can find good deals in the market.

The flat price growth means that property prices in many areas are very similar to what they were two years ago, which is quite unheard of and a huge benefit for buyers. At the same time, many motivated sellers are willing to consider serious offers.

Although more people are selling for financial reasons and consumers are under enormous pressure, the banks are still signalling that there has been no notable increase in distress in the market. Seeff says there is, unfortunately, little room for bargain hunters in the property market. If you are a serious buyer, however, you are likely to find a good price right now and can benefit once the interest rate comes down.

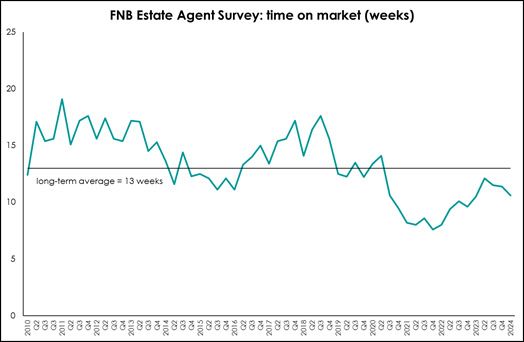

“According to FNB’s estate agency survey, increased housing market activity saw time on the market improve from 11 weeks and four days in Q4 2023 to 10 weeks and six days in Q1 2024, led by the Western Cape, where time on the market fell to seven weeks and one day, while Gauteng also registered an improvement”, shares Dr Andrew Golding, chief executive of Pam Golding Property Group.

“And despite slowing during the past year, relocation or semigration has remained elevated, rising from 11% in Q4 2023 to 13% in Q1 2024 – seen against the long-term average of 9% since the pandemic.

With a weak economy and uncertainty ahead of the general elections, the housing market is currently challenging, awaiting interest rate relief. Nonetheless, life goes on – children need to go to school, couples marry, and people accept jobs in new locations – all of which translates into property-related decisions, which include returning expats. We are also seeing renewed interest from international buyers, which incorporates those from the rest of Africa”.

What to expect next?

Adrian Goslett, regional director and CEO of RE/MAX of Southern Africa expects that growth within the local housing market will remain muted owing to affordability issues. “Interest rates will affect each suburb and price bracket in varying ways.

Lew Geffen Sotheby’s International Realty CEO Yael Geffen says, “Buyers are likely to be cautious, waiting to see what inflation does in the year’s second half. If lending rates come down, the market will see a sharp rebound,” Geffen predicts.