BetterBond

The residential property market is beginning to turn a corner after two difficult years of high interest rates. A combination of improving economic indicators, easing credit conditions and strengthening consumer finances is starting to translate into renewed activity, with home loan applications, approvals and prices all showing early signs of recovery.

The latest BetterBond Property Brief reveals that this shift is driven by factors beyond sentiment alone. Lower borrowing costs, real income growth among buyers and improving bank lending appetite are steadily restoring momentum to the market, while modest house price inflation suggests conditions are moving away from stagnation without yet overheating. For buyers and sellers alike, the data now points to the beginning of a new phase in the property cycle rather than a short-term rebound.

The month in numbers

- 10.4% YOY increase in bond applications

- 8.4% Increase in average house price since January 2024

- 4.1% YOY increase in building costs

- R1.6 million – national house price average

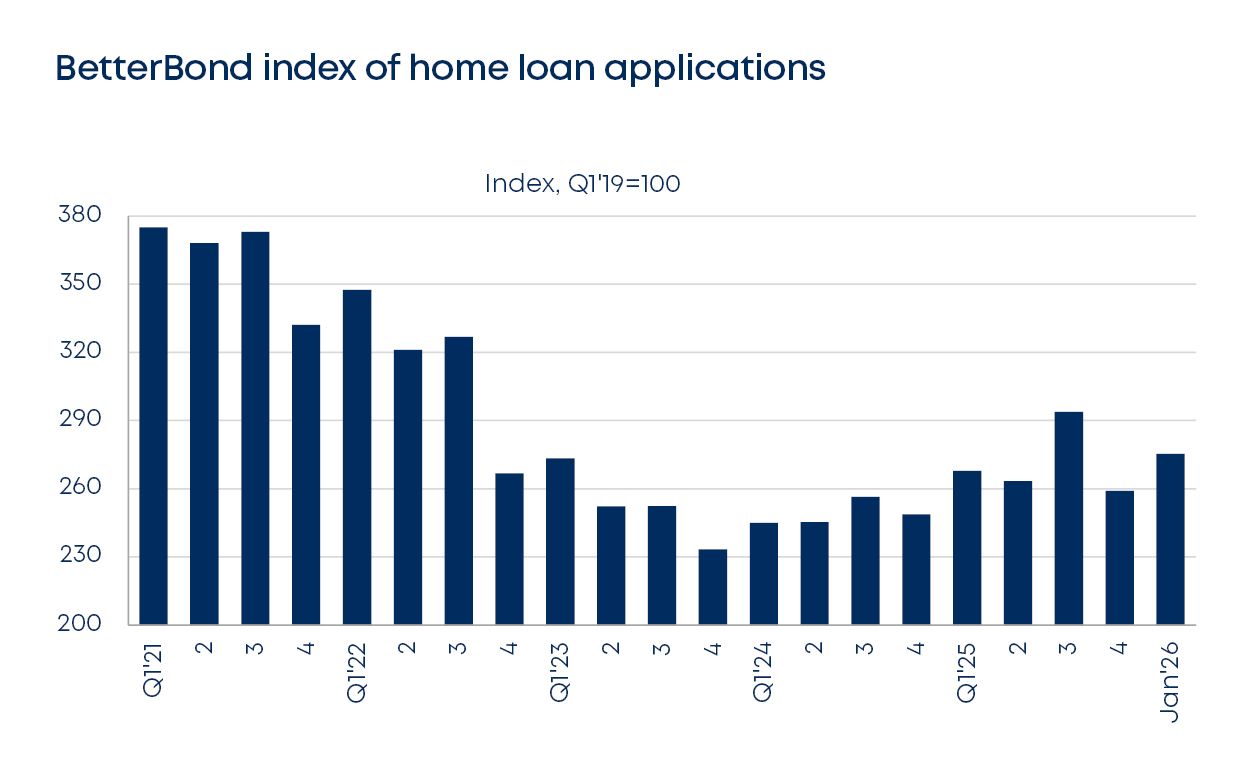

BetterBond Index of home loan applications

January witnessed the traditional recovery for home loan activity from the previous month, when seasonality comes into play due to the summer holidays and the Christmas season, which invariably lead to a predictable decline in the level of activity in several sectors of the economy, with retail trade a notable exception.

The regular Q4 slump is illustrated here, with a January recovery that increased home loan applications by 2.8% (compared to January 2025). When compared to the number of applications in January 2024, the performance is more impressive, namely an increase of 10.4%. It is clear from this data set that activity in the residential property market is shedding the negative effects of the record-high interest rates that existed in 2023 and 2024.

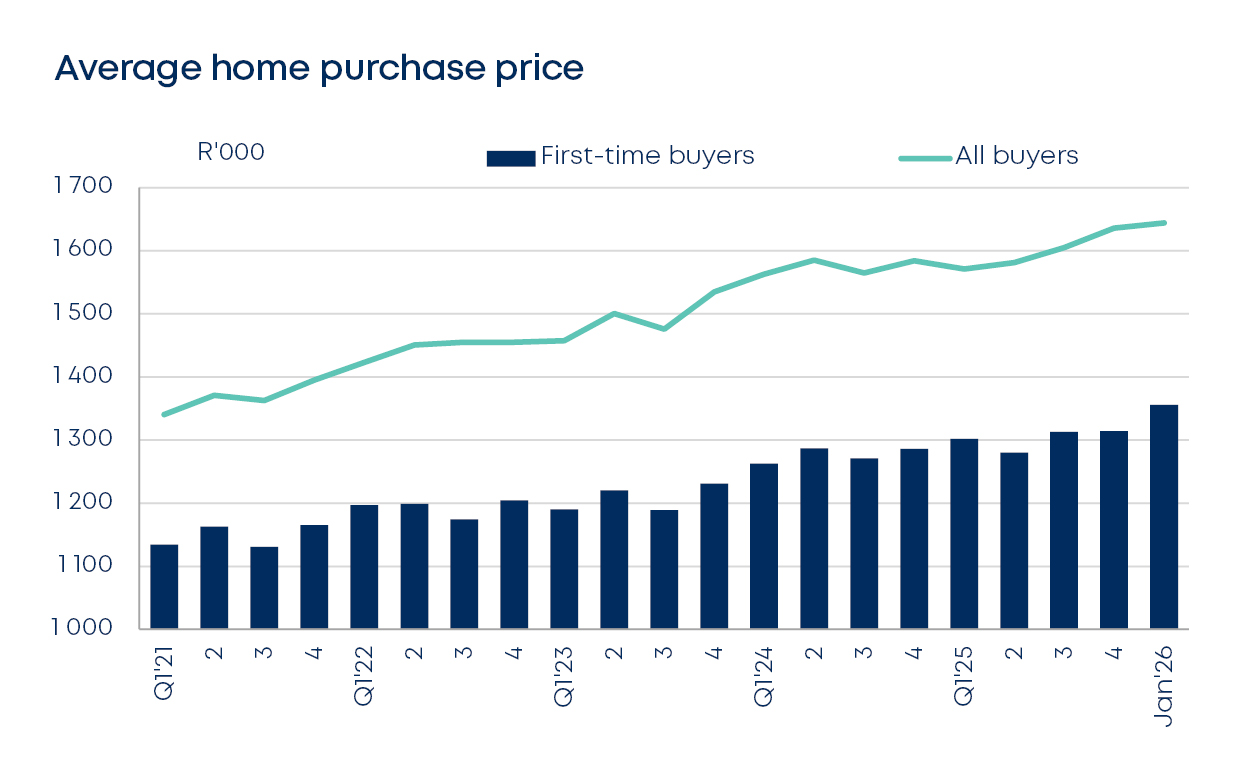

Average home purchase price

Average house prices continued with the improved upward momentum that has been evident since the prime lending rate (via the Reserve Bank’s repo rate) declined by more than 100 basis points, which occurred during the second half of last year. Since then, two further cuts have materialised, resulting in a current prime lending rate of 10.25%. In January, a YOY increase of 4.1% was recorded for all buyers, while average house prices for first-time buyers (FTB) only increased by 1%.

Viewed from a two-year perspective, average house prices for all buyers and FTBs have increased by 8.3% and 8.5%, respectively, reflecting modest real increases (after adjustment for inflation). If house price increases continue to outstrip the rate of increase in the consumer price index (CPI), the residential property market may start to attract speculative investment buyers, which should lead to even higher rates of house price increases.

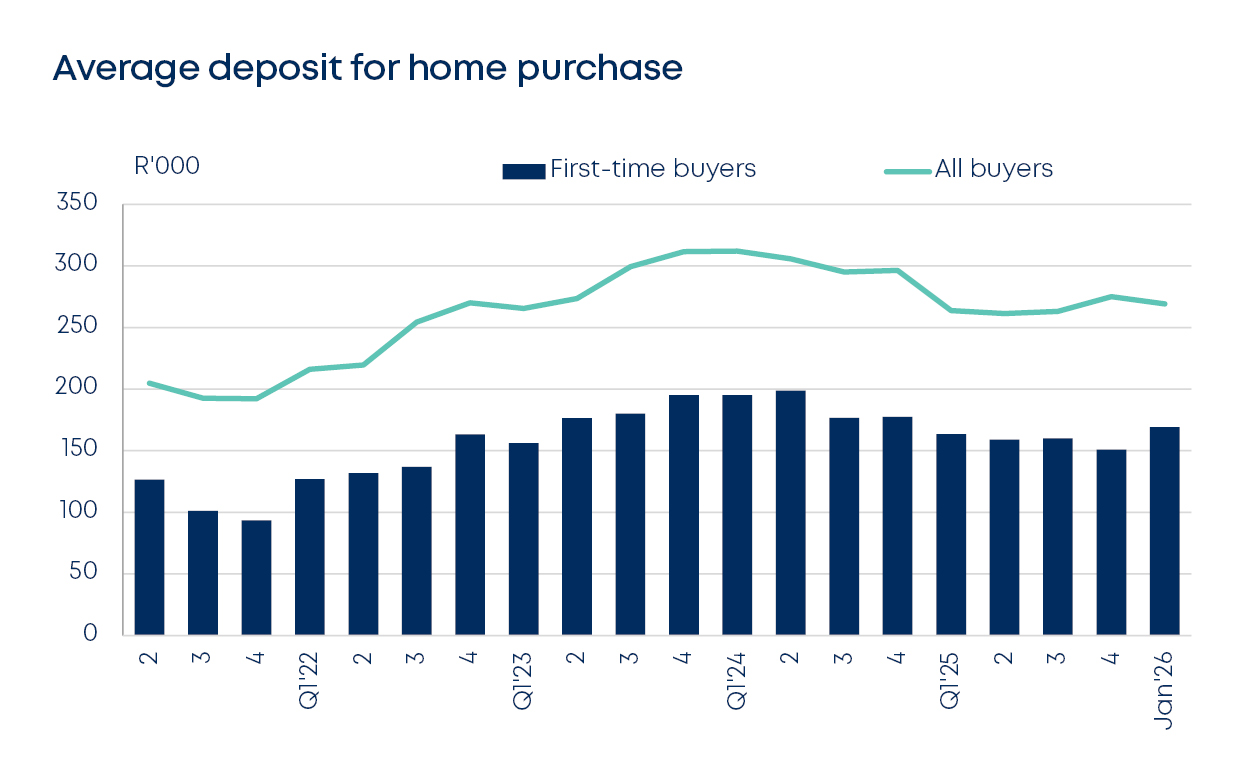

Average deposit for home purchase

The unfortunate decision by the monetary policy authorities in November last year to lower the inflation target range seems to have contributed to a halt in the downward trajectory of the deposit requirements for accessing home loans from the banks. The new effective target range is 3% to 4% (previously 3% to 6%), which will be more difficult to maintain, especially in the event of a meaningful exchange rate depreciation (which will serve to elevate the prices of most imported goods).

During January, the deposits required for home loans by FTBs actually increased, albeit marginally. Prospective homebuyers are nevertheless in a more advantageous position than two years ago, with declines in the deposit requirements of 9.2% and 10%, respectively, for all buyers and FTBs.

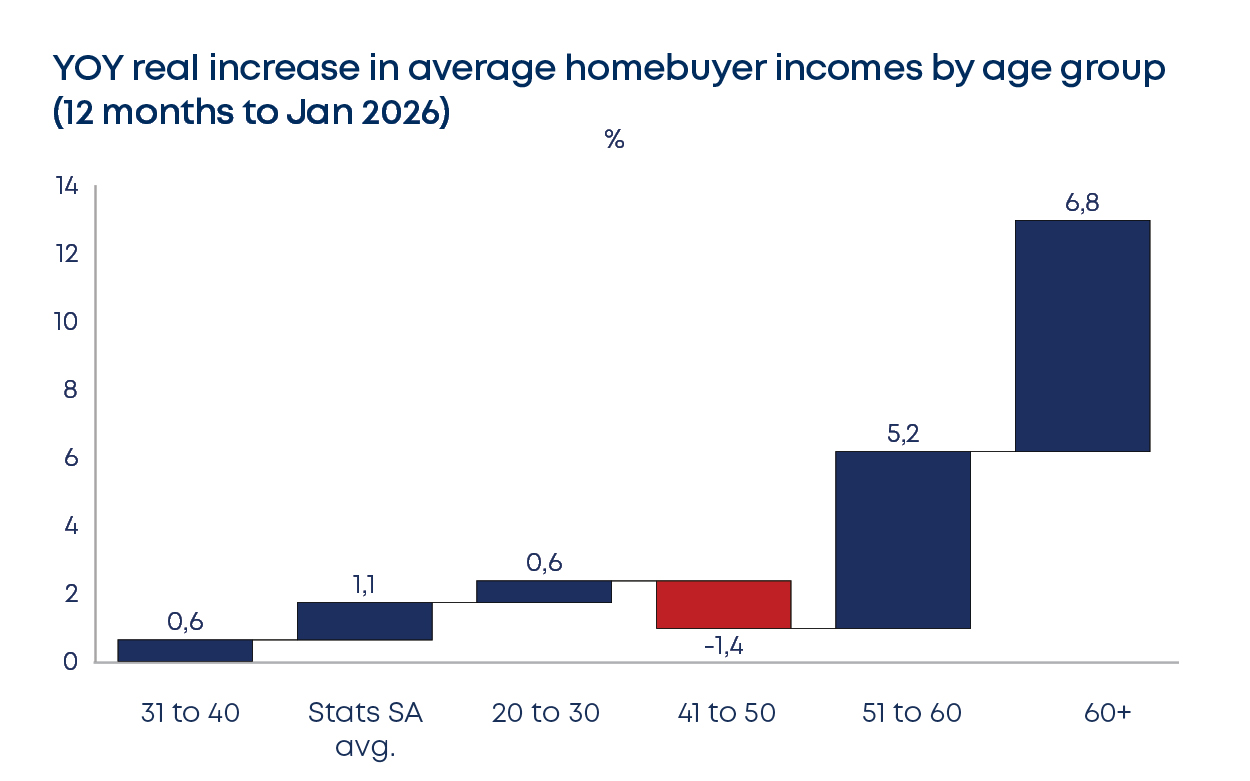

YOY real increase in average homebuyer incomes by age group (12 months to Jan 2026)

One of the most encouraging features of the BetterBond data sets on prospective homebuyers is the consistent increase in reported average incomes of people who apply for assistance with home loan financing. Over the past four years, the rate of increase in the incomes of homebuyers has outpaced inflation and the data for the 12 months to the end of January 2026 is no exception, except for the age group between 41 and 50 years.

The elder age groups (read: more experience) fared exceptionally well, with double-digit nominal growth in the average income of homebuyers over 60. With average inflation of 3.2% having been recorded by Statistics SA for 2025, the latter age group recorded a real increase in their average income of 6.8%.

Read the full Property Brief here