MAIN IMAGE: Johette Smuts, PayProp head of data and analytics.

Last year saw the rental rate trade sideways at below 4% with more of the same predicted for most of 2020.

“We’ve entered the new year with the continued threat of power cuts and an unstable economy that is unlikely to attract foreign investment in the short term,” says PayProp’s head of data and analytics, Johette Smuts.

Affordability is and will continue to be an important factor in South Africa with sub-inflation income growth increasing the pressure financially on consumers, and particularly in those provinces where rental growth outpaces inflation. Added to this, the over-supply of housing in some of the bigger provinces continues to suppress rental growth. “Supply is relatively inelastic, and demand will be slow to change in the short term,” says Smuts.

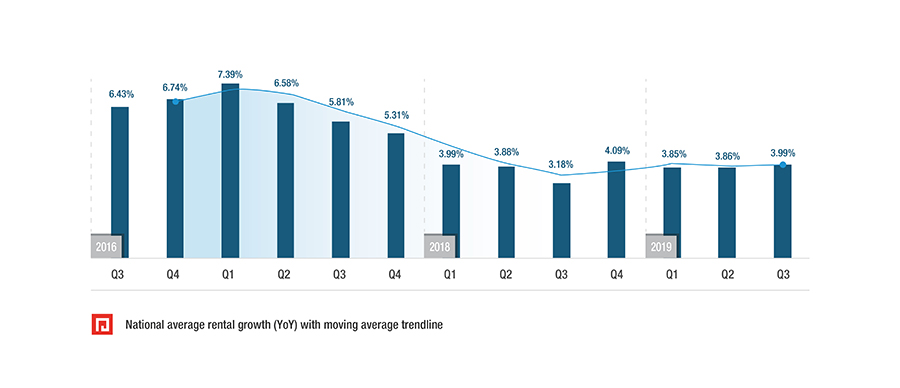

Smuts says that for most of 2017 and 2018, the South African rental growth rate trended downward. Rents still increased but the pace was much slower. However, in the last quarter of 2018, the country experienced its first uptick in quarterly rental growth (measured year-on-year) after six consecutive quarters of decline.

In 2019, we saw rental growth trend sideways at below 4%, trailing an already low inflation rate. The moving average line on the graph (which effectively smooths the growth rate, making the longer-term trend easier to see) confirms the sideways trend.

National average rental growth (YoY) with moving average trend line.

How do the bigger provinces compare?

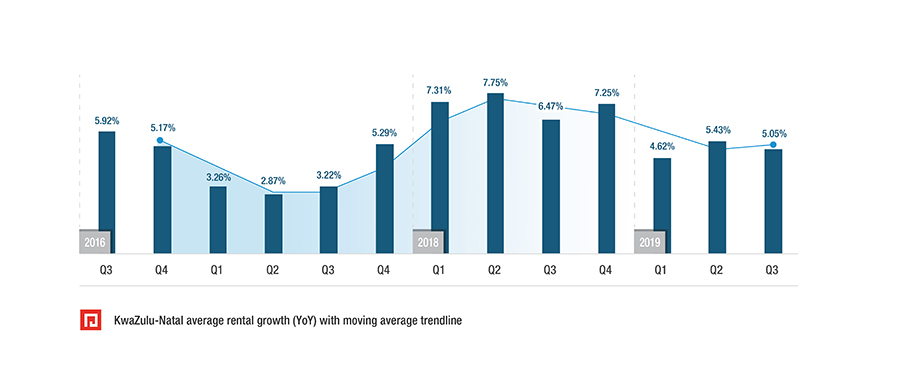

Provincial data shows that KwaZulu-Natal still experienced growth of around 5% last year – down from the 7% seen in 2018, but still higher than the national average. In contrast to a picture of nationwide declines, rent increases in KwaZulu-Natal rose through 2017 and much of 2018, but while growth in the province exceeded the national average, it did not escape last year’s trend of flat growth.

KwaZulu-Natal average rental growth (YoY) with moving average trend line.

The high growth of 2018 and above-average growth in 2019 made KwaZulu-Natal the second most expensive province after the Western Cape in which to rent. This could in turn affect affordability in the province if wages do not keep pace in 2020.

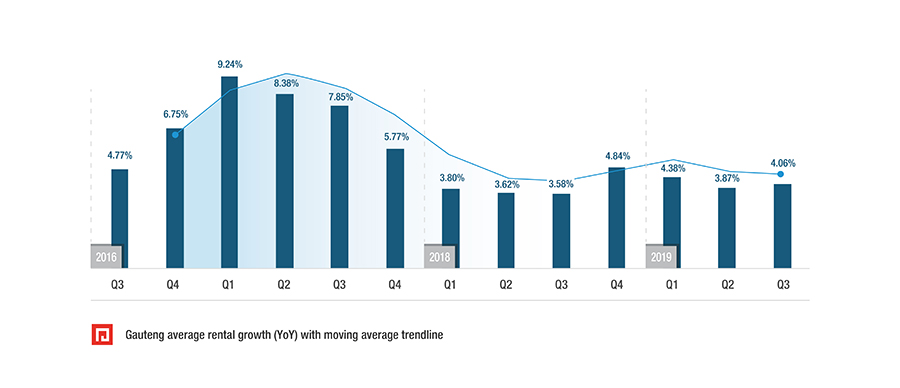

Gauteng average rental growth (YoY) with moving average trend line.

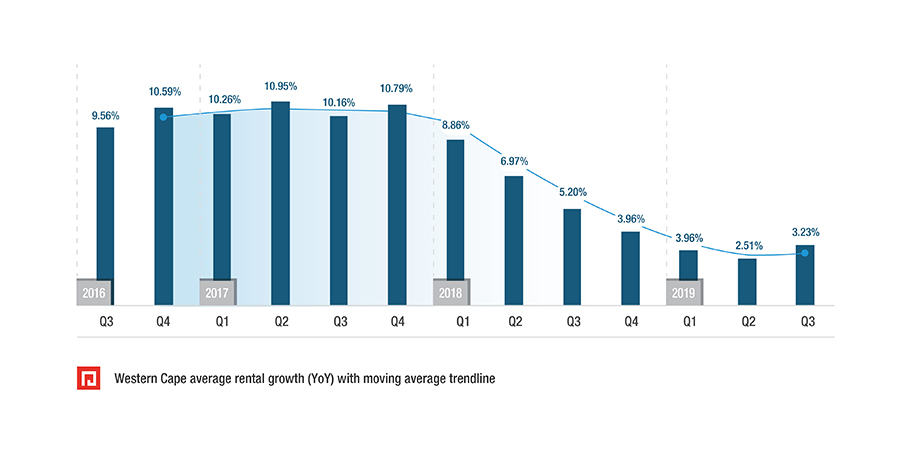

Western Cape average rental growth (YoY) with moving average trend line.

In both Gauteng and the Western Cape, we see rental growth that is closer to the national trend, although the Western Cape’s decline lagged by a few quarters. Recent figures are a long way away from the 9% or 10% seen just two years ago.

Both provinces also experienced a slight uptick in Q3 2019, but it is too soon to tell if that will continue in 2020 – particularly as increasing development of new rental units in both these provinces puts rental price growth under pressure. When tenants can move to more affordable housing, landlords find it difficult to demand high rent increases. Indeed, tenants squeezed by sub-inflation wage growth may opt to move to cheaper housing even without the threat of rent rises.

“Whilst we’re hopeful that the second quarter will show some improvement, it’s likely to remain unchanged. Added to that, with the immense financial pressure on South Africans, it’s important for landlords, rental agents and property owners to place risk management at the top of their priority list for the foreseeable future,” advises Smuts. “Don’t compromise on new tenant checks, rechecking before renewal, and diligently chasing arrears.”

Source: PayProp