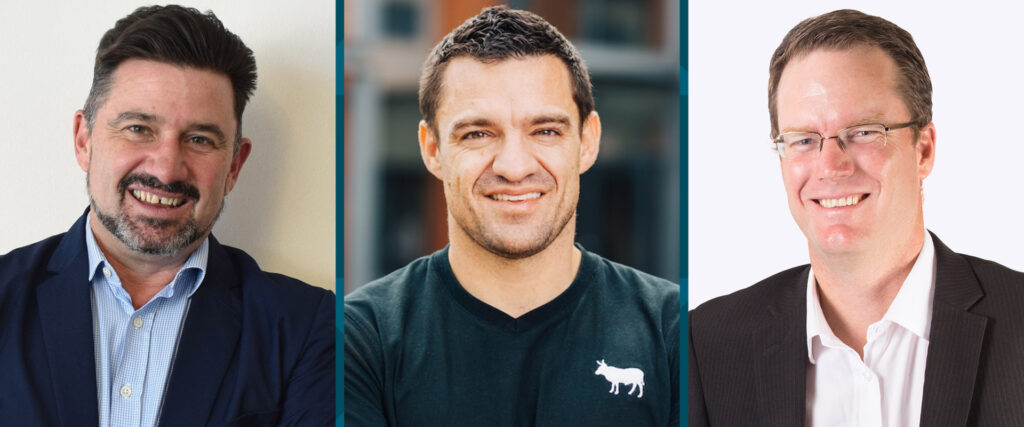

MAIN IMAGE: Rhys Dyer, CEO ooba Home Loans; Grant Smee, managing director Only Realty; Myles Wakefield; CEO Wakefields Real Estate

One of the post-Covid trends could be that more people chose to live near the coast as thanks to remote working it is no longer a must to live close to the office.

One of the lessons people took to heart during the lockdown was that where you live matters. Also, remote working was already a growing trend pre-Covid, but the lockdown appears to have resulted in more people choosing to continue working from home. Family, nature and lifestyle are the new priorities – and from that perspective considering a move to a coastal property would make a lot of sense.

Lightstone in their September newsletter says they expect many prospective homebuyers will take advantage of the low interest rates to make the move to live on the coast. Although the Q3 data on property transfers is not yet released, they expect to see an upswing in property transfers for residential properties on the coast.

Spike in home loan applications

Since June home buyers, especially first-time home buyers, have been eager to benefit from the favourable property buying conditions. According to Rhys Dyer, CEO of ooba Home Loans, the home loan industry are seeing levels of activity they haven’t seen in years. “As of September 2020, first-time home buyers represent 55% of ooba’s application volumes – up from the mid to high 40%. Most applicants (67%) are seeking a 100% bond application,” he says. “In some cases, it’s actually more cost-effective to buy than to rent in the current climate” Dyer adds.

According to ooba most of the home loan applications they’ve received in the price range R750 000 to R2 million are from coastal areas such as Cape Town, Port Elizabeth and KZN.

Cape Town

International investors: Due to the slump especially in the luxury property market, Cape Town has seen some price correction in some of the most desirable upmarket areas such as the Atlantic Seaboard, Clifton and Camps Bay. The current low interest rate combined with the weakened rand, are expected to encourage interest from international investors. Grant Smee, managing director of Only Realty, says they have seen an increase in the number of homes marketed to foreign investors. “Cape Town is a unique property market. Properties in tourist hot spots generally sell for R2.5 million-plus so attracting local buyers and tenants in this price category remains a challenge,” he explains. With the future of international travel still uncertain after months of travel restrictions, there has also been an influx of Airbnb units that are now up for sale. “While Cape Town is known to attract international buyers – particularly those from the UK and Europe – we expect to see a sharp increase in stats in the months to come,” notes Smee.

Semigration: Since interprovincial travel reopened, there appears to be a lot of interest from buyers in Gauteng about properties on the coast. Smee says they’ve also seen an increase in people moving from Gauteng to Umhlanga (KZN), Port Elizabeth (Eastern Cape) and the quieter parts of Cape Town. Even smaller towns along the Western Cape coast are growing in popularity. “The ongoing buyers’ market is presenting some great deals to buyers -particularly in coastal regions. We do however anticipate a decline in property market activity from early 2021 when the true effects of COVID-19 will be felt,” ends Smee.

Jim Alexander of PropertyTime has been in real estate in the George area for years. He agrees that most of their enquiries are from Gauteng, with lifestyle estates a popular choice, but adds that they are also seeing many people who are just looking, not ready to buy. “I think one needs to factor in that after lockdown, people need to ‘get away’ for a few days, and that might be part of the reason. ‘Kykers’ instead of buyers perhaps,” he notes.

Eastern Cape

East London: The Eastern Cape hubs of Port Elizabeth and East London have reportedly seen brisk activity for properties across all price ranges. Sean Coetzee, Pam Golding Properties area principal in East London, says they’ve seen some homeowners selling their homes to upscale to larger properties or moving to more expensive areas which are closer to major schools, beaches and other amenities. Investors are also keen to benefit from the low interest rates. The most popular price range is up to the R2 million mark, but several top end sales in the range of R5 million and up have also been concluded.

There are also more first-time buyers who are renting as well as Eastern Cape buyers from areas such as King William’s Town and Mthatha who had work transfers or are seeking better schooling. In demand is secure, lock-up-and-go properties which is resulting in more sectional title sales.

Port Elizabeth: In Port Elizabeth, the township property market is busy but there also properties priced over R2 million that are selling. Well priced properties are not in the market for more than a few weeks – especially family homes, says Justin Kreusch, an area principal for Pam Golding Properties in Port Elizabeth.

They are seeing more first-time buyers as well as investors eager to invest in property on the city’s beachfront, says Nikki Strooh, Harcourts Beachfront principal. In many instances, buyers are finding it cheaper to buy than to rent, for instance a one bedroomed unit in Humewood was available to rent for R5 000 but sold for R620 000. The bond instalment, without putting down any deposit is only R 4,806 – a saving of R194.

The Amdec Group’s multi-generational estate Westbrook has also benefited from the current buyer trend to opt for estate living. According to managing director Clifford Oosthuizen their first village, The Ridge, is sold out and 24% of the first phase of their second village sold in a month, before construction even began. He believes the spike in buyer interest in gated living will continue long after Covid-19.

KZN

The laidback lifestyle on KZN’s coastline combined with the abundant and varied offering in lifestyle estates, particularly on the north coast, has seen an increase in buyer activity over the last years. However, the past three months, the market has been surprisingly busy, says Myles Wakefield, CEO Wakefields Real Estate. He attributes this in part to the low interest rate, but adds that in Umhlanga, increased stock has also come on the market due to homeowners who had to downscale due to financial pressures. “Having said that, in our experience, there has not been a noticeable increase in demand for coastal properties in this third quarter of 2020,” he remarks.

Most of the buyers in Umhlanga are from KZN and there’s a demand for sectional title units. On the north coast most buyer interest is in lifestyle estates.

Early days still but an interesting trend to watch. Afterall, don’t most of us want a ‘huisie by die see’?