Staff writer

Wonder what the property market is doing? We share the February BetterBond Property Brief highlights and quickly look at what’s happening per price bracket and region.

- 45% – the percentage of BetterBond home loans for purchase prices below R1 million

- 5.1% – YoY increase in average home prices for first-time buyers

- 52% – Gauteng’s share of home loans in the past 12 months

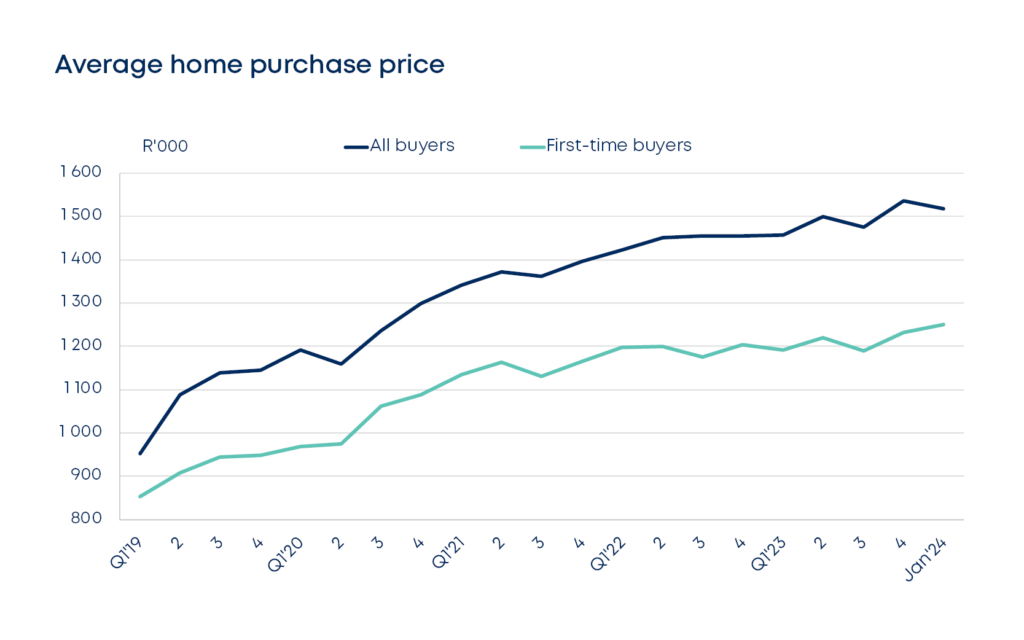

Home purchase prices

A measure of resilience remains in the residential property market. January saw YOY increases in average home purchase prices for all buyers (4.2%) and first-time buyers (5.1%), whereas in QOQ, there was a marginal decline of 1.1% for all buyers and a modest increase of 1.6% for first-time buyers. With the rate of annualised consumer inflation still marginally higher than the rate of increase in home prices, buyers still have an advantage over sellers.

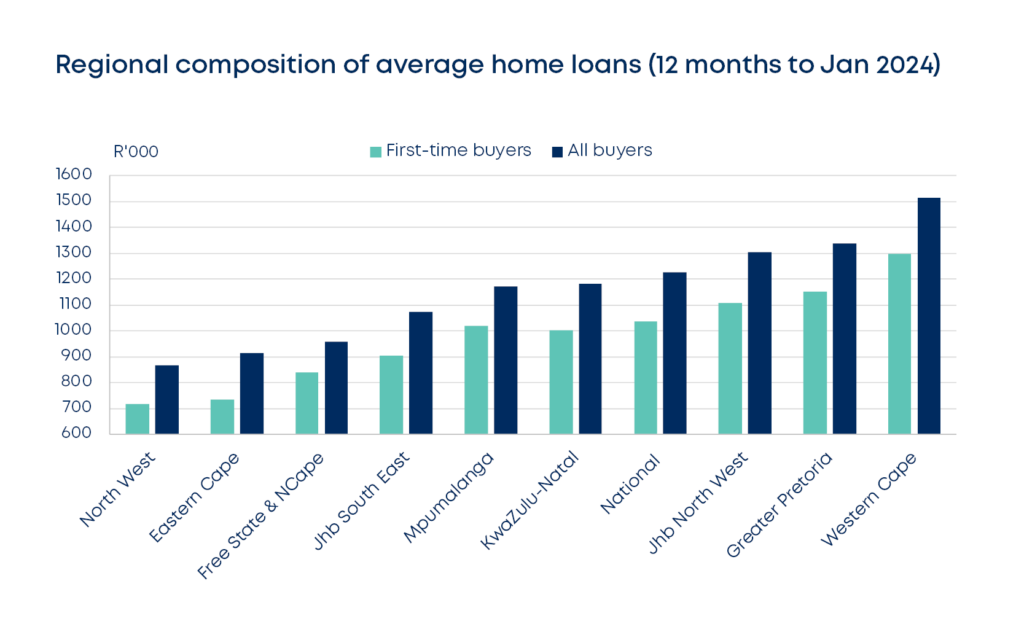

Regional composition of average home loans (12 months to Jan 2024)

During the 12 months to Jan 2024, the Western Cape remained the top region for home loan values. At an average value of just over R1.5 million, home loan values in the Western Cape were 13% higher than in Greater Pretoria and 75% higher than in the North West province. Compared to the national average, home loan values in the Western Cape are 24% higher. One reason why home loan values have been muted could be due to increased deposits required from prospective homebuyers.

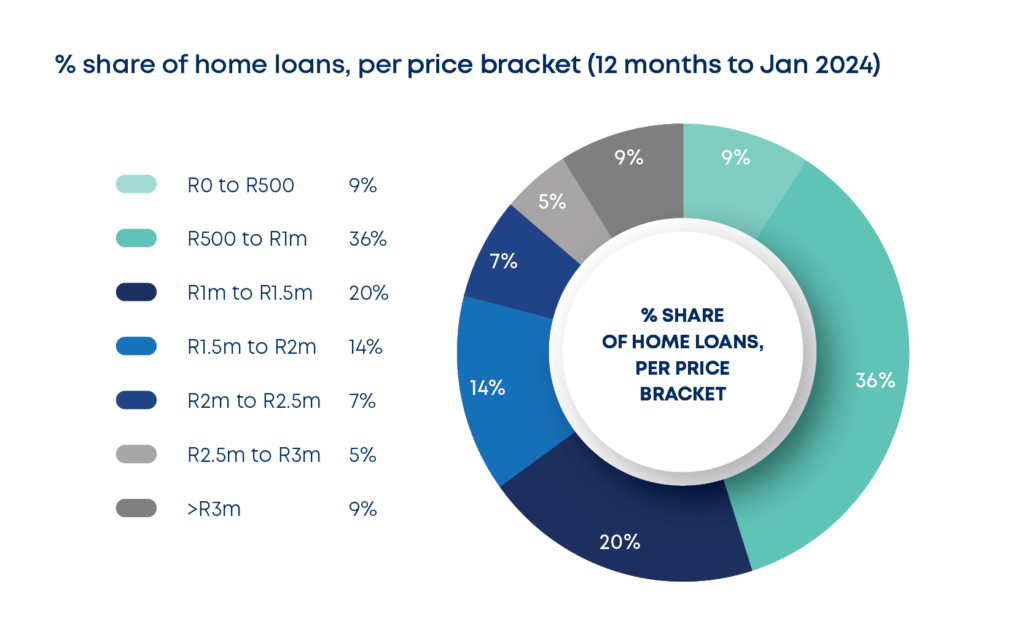

Percentage share of home loans, per price bracket (12 months to Jan 2024)

Over the past 12 months, the share of home loans for purchase prices below R1 million has continued to dominate homebuying activity, representing 45% of total home loans awarded. Against the backdrop of high interest rates and subdued economic growth, this trend is not surprising and likely to remain until interest rates start coming down. Fortunately, new job creation has continued over the past two years, which provides the residential property market with a growing base of potential demand. The first three quarters of 2023 saw 811,000 new jobs being created in the economy.

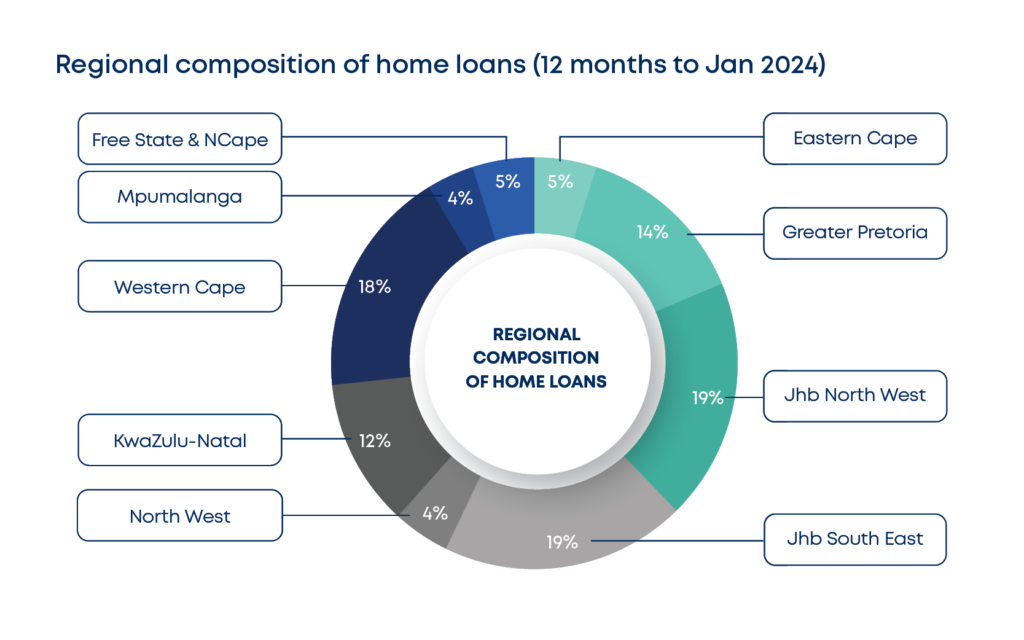

Regional composition of home loans (12 months to Jan 2024)

During the 12 months to Jan 2024, Gauteng continued to dominate the home loans market with the BetterBond regions of Greater Pretoria, and the two Johannesburg regions, accounting for more than 52% of all home loans awarded. After Gauteng, the Western Cape and KwaZulu-Natal recorded the next best home loans activity. In the current macro-economic environment of subdued growth and higher debt-servicing costs, home loan activity is likely to remain somewhat constrained, but prospective buyers are in good bargaining positions.

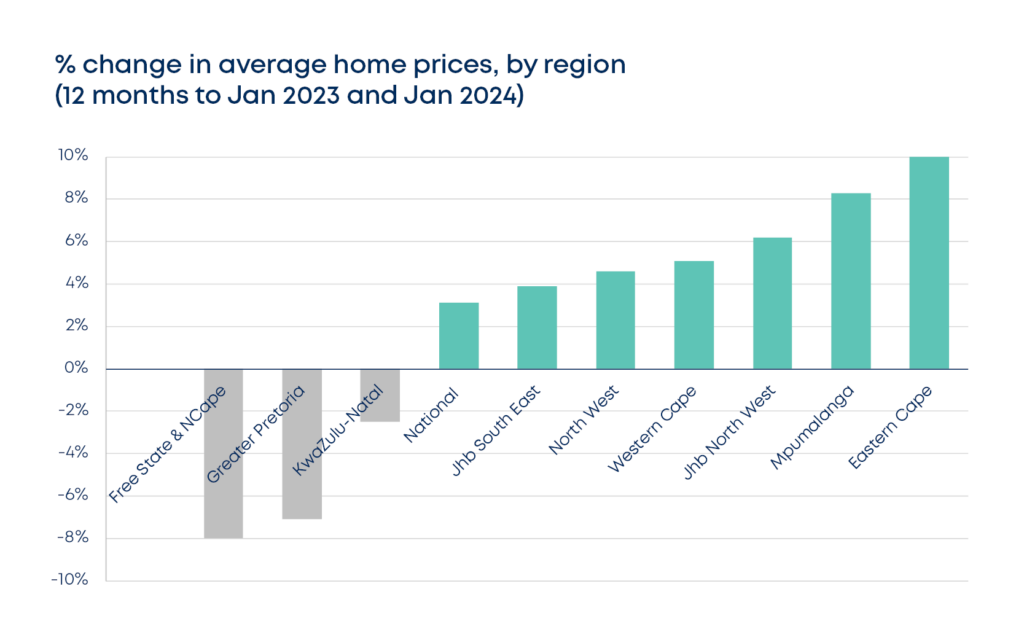

Percentage of change in average home prices, by region (12 months to Jan 2023 and Jan 2024)

Over the past 12 months, most BetterBond regions experienced increases in average home prices, the exceptions being KwaZulu-Natal, Greater Pretoria, and the Free State & Northern Cape. The friendly city of Gqeberha came out on top, with a 10% average YOY increase, followed by Mpumalanga.

The quality of municipal services plays a role in homebuyers’ choice of location and residential property experts will assess with keen interest the impact of the results of the national general election on the future regional composition of home prices.

Read the full report here.