MAIN IMAGE: From left, Paul-Roux de Kock, Lightstone Property analytics director, Schalk van der Merwe, Rawson Helderberg franchisee and Adrian Goslett, regional director and CEO of RE/MAX of Southern Africa.

While the property market impatiently wait for the elections to be over with the hope that there will be a return of more activity, research group Lightstone Property reveals their latest data shows single women are now dominating the residential property market in South Africa in terms of volume.

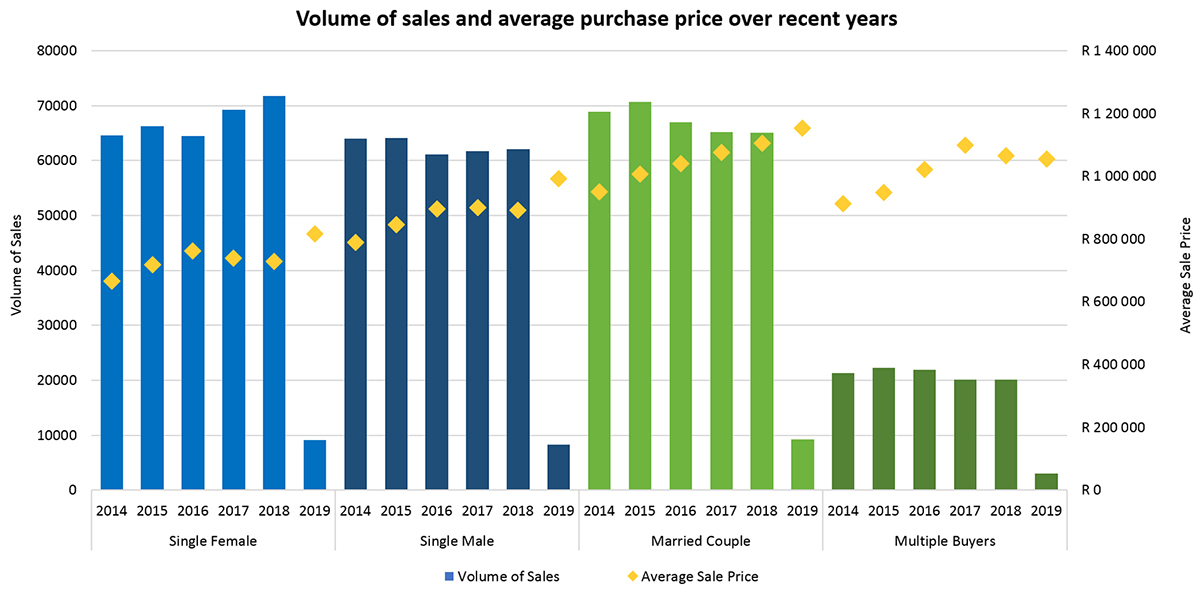

Lightstone’s analytics director Paul-Roux de Kock says one of the most encouraging findings in the research group’s latest property data analysis was that the number of single women buying homes rose to 71 727 in 2018 which is almost 10 000 more than the 62 032 sold to single men in the same time period.

This makes single women the dominating force on the property buying scene in terms of volume – surpassing also the amount of homes sold to married couples (around 65 000) and to multiple buyers (20 000) – but men on average still buy more expensive houses than their female counterparts.

Read more here

The last couple of years have seen a rising trend of single women buying property. Last year Cindy Bezuidenhout, lead analyst at Lightstone Property, said their data shows that female buyers have been steadily increasing since 2016 – possibly an indication that women are becoming more economically empowered Bezuidenhout said.

Read more here

Female ownership statistics. Source: Lightstone Property

Cape Town still has highest property growth

Despite the impact of last year’s drought, Cape Town’s property growth remains above the national average says Le Roux.

Schalk van der Merwe, Rawson Properties Helderberg franchisee, says they have seen an average growth of 34.6% in property prices in the last four years even though there were fewer sales due to the economic downturn.

“Sectional title schemes – which tend to be particularly popular with younger buyers – performed even better than average, with 58% growth if we include 2019’s sales so far,” he adds and says also sales in the under-R3million price bracket has actually increased by a full percent in the last three months.

Le Roux predicts that Cape Town as a bustling cosmopolitan province should continue to show steadfast and reliable growth in the years to come.

Hope for economic upturn after elections

In light of the multiple challenges faced by the country during the first term, it comes as no surprise that property market sentiment was negatively affected yet at 73% overall (down from 77% in the fourth quarter of last year), it indicates that most people still feel positive about investing in property. Absa’s property analyst Jacques du Toit, said positive factors include that property is seen as a secure asset that still increases in value. On the negative side were political uncertainty, the poor performance of the economy and continued uncertainty about the outcome of land expropriation without compensation.

Du Toit said economic growth is expected to improve from 0.8% in 2018 to only 1.3% in 2019. The good news is that inflation is expected to remain around the mid-point level of 4.5% of the inflation target range of 3%-6% and interest rates are forecast to remain unchanged for the rest of the year.

“Consumers have in general not been very confident about the outlook for the economy and their own financial positions in the first quarter of the year, while there is still uncertainty about the outcome of the general election. Property market sentiment will remain largely dependent on the above-mentioned factors, with sentiment that may change after the election and which will be reflected in levels of market activity, buying patterns, transaction volumes, property price growth and the demand for and growth in mortgage finance,” Du Toit explained.

With the national elections finally over this week property experts have expressed hope that activity in the property market will pick up in the next months.

Adrian Goslett, regional director and CEO of RE/MAX of Southern Africa, said many investors prefer to wait for a few months both leading up to and following an election period to see if any changes come into effect that might hinder their return on investment,” Goslett explains.

“Once elections have come and gone, it is likely that we will see activity slowly begin to increase in the property market over the coming months. It is unlikely that the market will see any immediate or substantial changes until the election hype has subsided and investors have more confidence in the policy decisions made by the elected government and its cabinet,” says Goslett.

In the short-term, it is therefore likely that the housing market will continue much the same as it has been in previous months. As at the end of March 2019, Lightstone Property revealed that the national house price inflation index was at 3.4 %. Annual consumer price inflation increased to 4,5% in March 2019, pointing to real house price decline of 1.1%. What’s more, Lightstone Property predicted three different scenarios for house price growth for the year, their most likely outcome being a 3% house price inflation rate for the year. However, their high-road scenario places house price inflation at 4.5% for the year, which would possibly beat inflation if we contain the upward risks that threaten its stability.

“From a personal perspective, I am confident that the property market will deliver strong long-term returns following the elections, so much so that I am not only going to hold onto my existing property, but am also looking for additional properties in which to invest in order to purchase while prices are still low and reap the rewards of the long-term price appreciation which I believe is to follow. I also believe that buyers who enter the market now stand the best chance of maximising returns if they are willing to wait for the ensuing price curve,” Goslett concludes.

You are welcome to email your comments and questions to editor@propertyprofessional.co.za.