MAIN IMAGE: The nationwide lockdown will severely impact the real estate industry in South Africa.

The 21-day lockdown in South Africa will severely impact the local real estate industry. There are many restrictions facing estate agents such as the Deeds Office that will be closed, but there are also options for small and medium agencies to apply for financial relief.

Tonight at midnight heralds the start of the nationwide lockdown announced by President Cyril Ramaphosa on Monday night. This step, though unavoidable, is expected to take South Africa into a deep economic recession. Many smaller businesses are very worried about the next three weeks of lockdown – a period that may even be extended if there hasn’t been a significant decrease in the number of new infections from the novel coronavirus.

How will they make mortgage payments or rental levies due for their office premises? Smaller agencies are concerned about compensation for their estate agents who rely solely on commission but won’t be able to earn while property transfers have to wait for the Deeds Office to reopen.

The government, the banks and the private sector are putting plans in place to offer some relief to businesses in distress. Here’s why there is lockdown, how it affects estate agencies and what is known about the business relief plans available so far.

Is a lockdown necessary?

Medical experts agree that it is the best course of action at present. In less than a month the number of confirmed new coronavirus cases in South Africa has escalated from zero to over 700 by Wednesday 25 March, and the number is expected to increase further. Internationally a full lockdown has proved the most effective response to slow the rate of infections from the highly contagious and deadly SARS-COV 2 virus (which causes the respiratory illness COVID-19). Slowing the rate of infection will buy the local health services some time to cope with the expected demand for intensive respiratory care. The virus is particularly dangerous to older people and people with compromised immune systems – a grave concern since South Africa have thousands of people with tuberculosis and/or HIV and/or diabetes.

South Africa’s decision to enforce a complete lockdown follows in the wake of countries in Asia, Europe, India as well as certain states in the US that have also instituted complete lockdowns in a desperate effort to curb the viral pandemic.

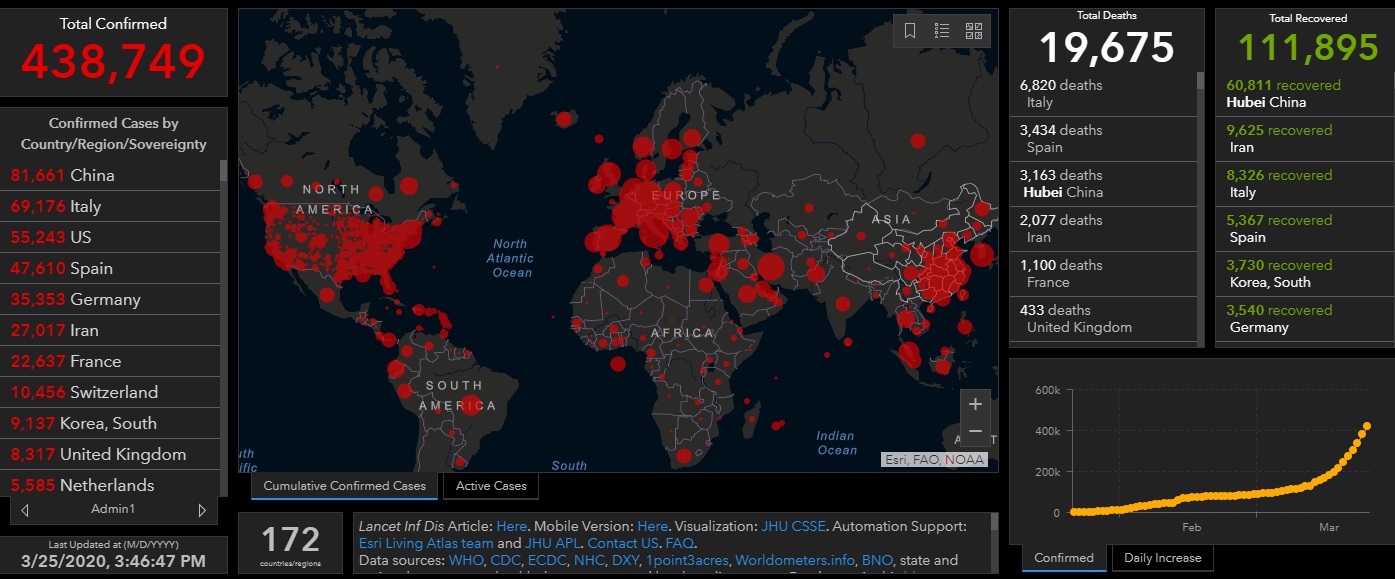

The coronavirus pandemic has necessitated that many countries implement lockdowns to curb the spread of the virus. This was the state of the pandemic on Wednesday 25 March 2020. Source: John Hopkins University Coronavirus Resource Centre.

How does the lockdown affect the real estate business?

All property practitioners will have to stay at home and all offices of estate agencies and conveyancers are closed. The Deeds Office is also closed. The effect of these restrictions is that many obligations can’t be complied with, for example:

- A tenant will not be able to vacate property during the lockdown.

- Landlords will not be able to give occupation to tenants during the lockdown.

- Estate agents will also not be able to attend to incoming and outgoing inspections.

- Estate agents can’t meet with clients face to face or take them to view listed properties that they are interested in.

- Valuators can’t inspect properties.

- No clearance certificates issued by municipal councils

- The Deeds Office is closed which means no property transfers can occur during the lockdown period.

- No transfers mean no income for estate agents and commission for estate agencies to pay for overheads.

The government this week published the lockdown regulations. A full list of businesses that should remain open have also been published.

The President has been very clear that there will be no exceptions and that these measures will be strictly enforced with the help of the South African National Defence Force till the end of the lockdown – currently set for midnight 16 April but the possibility exists that if the number of new infections have not decreased, that this period may be extended.

What plans are in place to bring economic relief?

The following measures have been put in place to mitigate the economic impact:

A Solidarity Fund which private businesses, organisations and individuals can contribute to. The fund will focus on efforts to fight the spread of the virus, tracking it’s spread, care for those who are ill and support for those whose lives are disrupted. The fund has a website www.solidarityfund.co.za.

Financial support for businesses in distress

- Trade and Industry Minister Ebrahim Patel this week announced that his department together with the Industrial Development Corporation (IDC) put together a package of over R3 billion in financial support for South African-owned businesses that are in distress and to fast-track financing for firms seen as critical in the fight against the virus and it’s economic impact.

- The Rupert and Oppenheimer families have committed R1 billion each for business relief. The details of how this funding will be administrated are being finalised.

- The Department of Small Business Development has a debt relief fund for small and medium-sized businesses that require help during the crisis. To apply register on smmesa.gov.za. Business will be required to provide proof that the negative impact is as a result of COVID-19.

- Small businesses can also apply for assistance through the Small Enterprise Development Agency (SEDA).

Banks – The banks have received exemption under the Competition Act to coordinate on measures that will offer debt relief and support to businesses and individuals. FNB, Standard Bank and Nedbank have already indicated that they will put measures such as ‘payment holidays’ and ‘debt relief’ in place to help mitigate the economic impact of the lockdown on individuals and businesses.

UIF, tax subsidies – Government is looking at providing further relief through the possible utilisation of UIF funds and through tax subsidies.

Property portals – The countries biggest property portals, Property24 and Private Property, have both announced that they’ve cancelled the annual price increases scheduled for 1 April.

Property Professional will report on any further developments in terms of financial aid to businesses in distress.

Will this be enough?

Only time only will tell. This is unchartered territory for all involved. South Africa’s economy is weak and is likely to take a further knock from the economic impact of the lockdown and, if necessary, continued restrictions in the fight against the spread of the virus. However, the recent 1% rate cut announced by the Reserve Bank and the expected substantive drop in fuel prices in April both offer welcome relief to cash-strapped consumers. Many estate agencies say they remain confident that the property market will bounce back after the lockdown period is over – after all, South Africans are known for their resilience.