Editor

As we near the end of Q1 2024, the BetterBond team takes a look at what’s happening in real estate, and there is good news:

- R1.3 million – the average home loan for first-time buyers in the Western Cape

- R50.4 billion – the value of residential building plans passed in 2023

- 17% – the increase in average home buyer income in 2023

- 7.8% – the quarter-on-quarter increase in home loan applications

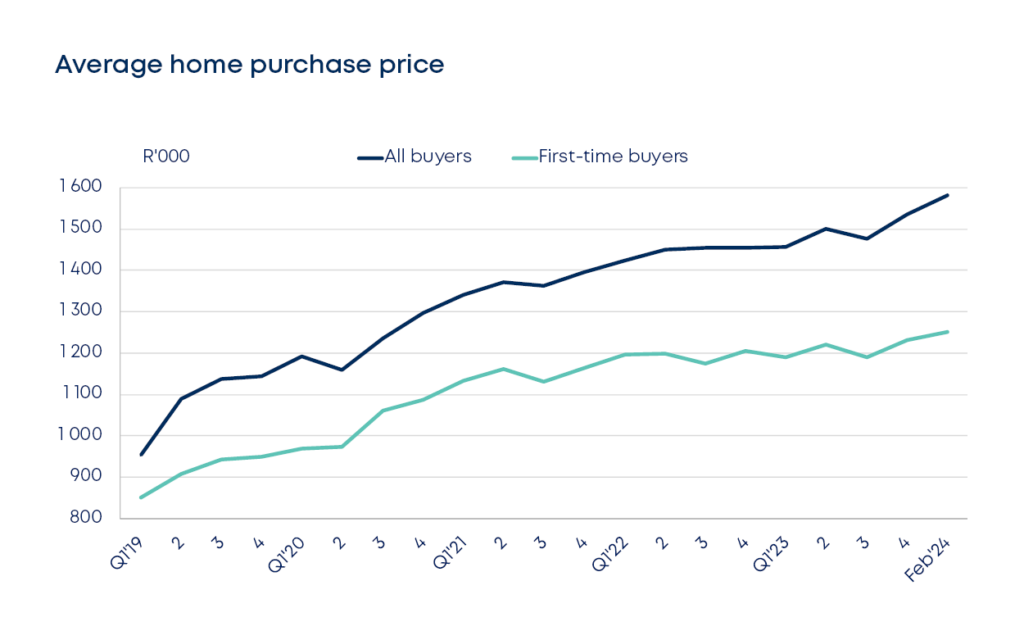

Home purchase prices

The residential property market is showing signs of a turning point with an impressive year-on-year increase of 8.5% in the average home purchase price for all buyers. This positive trend continues after adjusting for inflation. First-time buyers also experienced a year-on-year increase of 5.2%, aligning with the latest consumer price index reading. These figures indicate a new upward trend in average home /

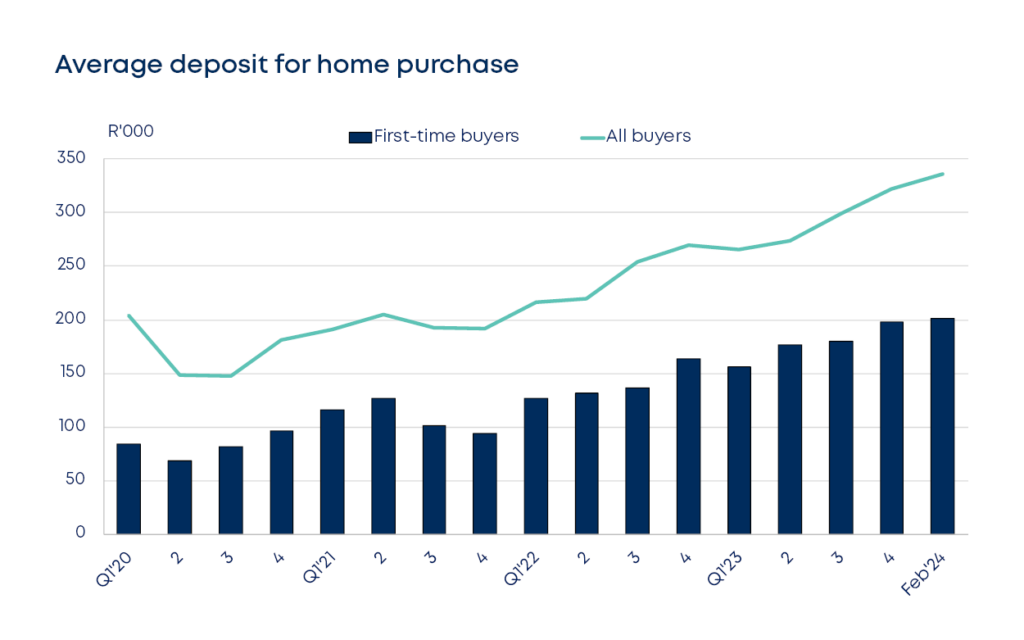

Average deposit for home purchase

The average value of deposits required for home purchases, which saw a significant increase due to the Reserve Bank’s restrictive monetary policy, is showing signs of stabilizing. After a staggering 56% increase for all buyers between Q1 of 2022 and February 2024, the increase in February was only 4.4% compared to Q4 of 2023. This suggests a potential easing of the financial burden on homebuyers.

As a direct result of higher interest rates, home loan lenders have been confronted by increases in non-performing loans, with credit impairments by the banking sector having risen markedly during 2023. With a bit of luck, March may witness a decline in the Reserve Bank’s official repo rate, which could spark a more accommodating environment for home buying.

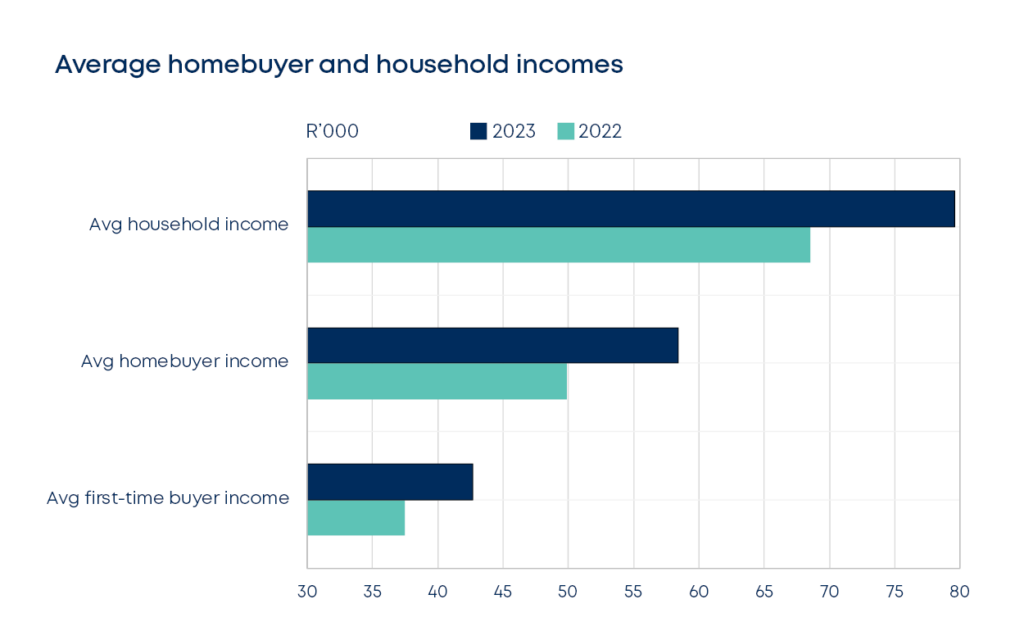

Average home buyer and household incomes

The incomes of homebuyers are considerably higher than the average salary of formal sector employees in South Africa. According to the latest Quarterly Employment Statistics published by Stats SA, the latter was at around R26,000 per month during Q3 of 2023, while the average homebuyer using BetterBond’s services was earning more than double this figure (R58,400). This is not surprising because there are 46 job categories surveyed by Stats SA that pay more than the average, including the electricity sector (R58,700), computer services (R53,000) and financial intermediation (R51,400). A feature of the BetterBond data is the substantial increase in average home buyer incomes over the past year, namely 17%, which can partly be attributed to scarcities in some high-level skills categories